Commercial

As we round out the series of articles based on the findings of the Valuation Insights Report, produced by the Australian Property Institute earlier this year, the last sector to discuss is Commercial property.

When comparing the various property classes (outside of Agribusiness), the leading property class and location was Industrial Warehouses (Sydney), with a 261% change in value over 20 years. This category and location were well in front of other assets, with Sydney Commercial coming in second place at 176%. Following further down the list were Adelaide Industrial at 173%, Perth Commercial (168%) and Melbourne Industrial (159%). By comparison, the inflation rate over that period, 2005-2025, was 66.8%.

For commercial properties over this time, the COVID-19 pandemic has had a significant impact. In different ways, these asset types, Commercial and Industrial, have two very distinct stories to tell.

We will start by exploring what has occurred in the Commercial space.

The impact of COVID-19 was felt strongly in the office sector, with the imposition of work-from-home protocols during the relevant lockdown periods. Office staff have subsequently changed the way in which they work, with most office employees now adopting a hybrid working environment and changing the way office space is utilised. With staff only coming into the office 2, 3 or 4 days a week, there is an increasing shift to ‘hot desking’ rather than having a dedicated individual workspace.

To entice employees back into the office, spaces have evolved to accommodate. Office buildings are now starting to incorporate eateries, childcare centres, green space and artistic installations to make the day at the office more appealing.

The continual strive for greater environmental efficiencies and the drive to net zero have led to demand for more sustainable buildings, with ‘green facilities’ such as fully electric services and EV (electric vehicle) chargers, as well as improved end-of-trip facilities for employees who cycle to work.

Infrastructure changes, expansion of cities to match the growing population, and the move to satellite cities have led to developments around public transport hubs.

While the appeal of lesser-quality or older office facilities has diminished, these types of offices took a hit during COVID, in particular. There is a shift towards retrofitting these facilities, many of which have been converted into co-working spaces or adjusted to accommodate smaller tenancy sizes, catering to organisations that are not yet required to undertake ESG reporting requirements similar to those of larger organisations that traditionally require larger floorplates.

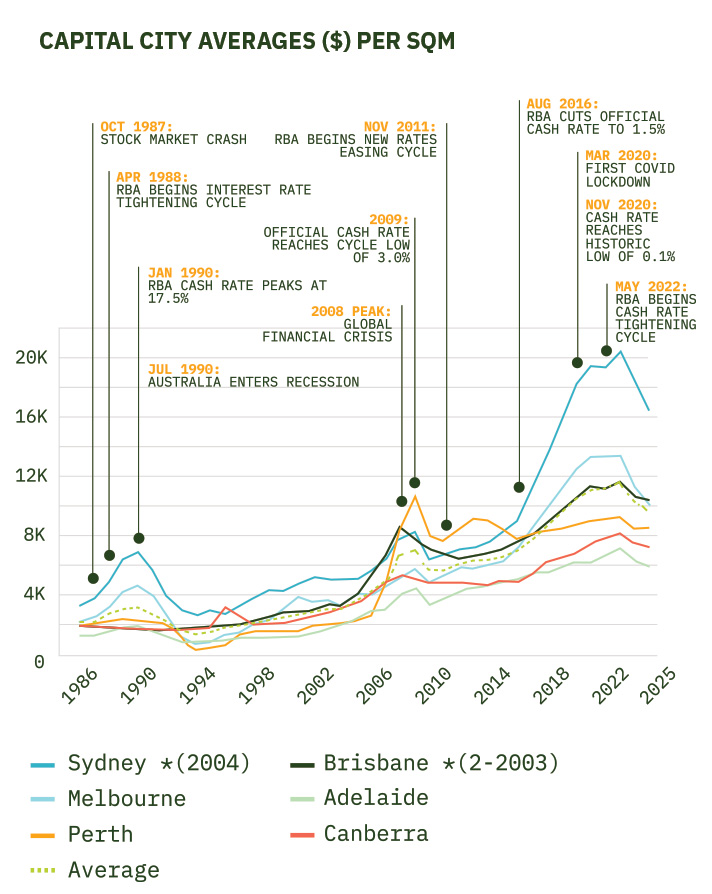

CBD Office Capital Values — A-Grade

The above graph shows the average $/sqm across all capital cities (A-grade office space), and whilst the COVID pandemic shows a definite plateau in this sector, the impacts of COVID were not at the scale of the sharp declines that were seen during the Global Financial Crisis or the “recession we had to have” in the early 1990s.

Industrial

The story of Industrial also reflects the growing population in our cities and regions and shines a light on consumer sentiment.

“COVID gains in the past five years make up the majority of the increase in industrial land over the past two decades in many markets.” (Australian Property Institute).

As our cities grow and our appetite for global consumerism strengthens, the industrial sector has expanded. During the pandemic, online shopping boomed, with the industrial sector also booming as the needs of society for distribution centres housing the increased volume of online purchases. Supply chain disruptions also led to a push for these storage facilities to branch out into larger spaces, so that inventory is available domestically for faster shipping.

Proximity to transportation routes for goods distribution and for accessibility of the workforce are key drivers for growth.

Whilst there is a shortage of appropriately zoned land ready to fulfil the pipeline for developments over the next decade, the push towards automation may start to change the requirements in terms of space and amenity.

During the pandemic, industrial property was seen as the “Cinderella story,” with its performance in this market contrasting the downward trend of other markets.

Acumentis are well placed to assist you with your property decision-making process. The expert valuers at Acumentis have decades of experience across all aspects of property. Whether buying or selling the looking to invest or needing specialised property advice, we can provide you with trusted knowledge on all your property matters.