Stabilisation and Future Trends

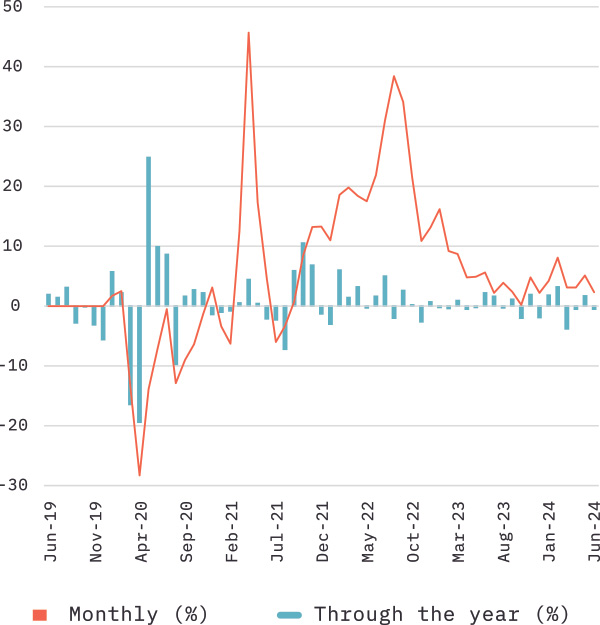

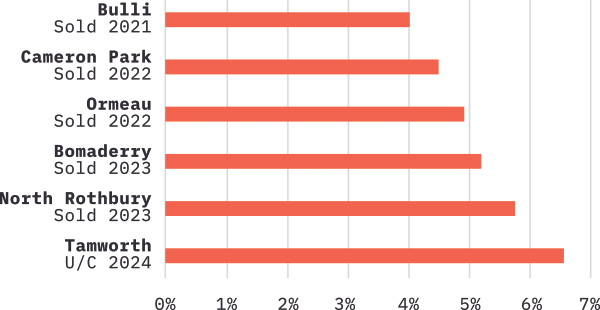

Having experienced a buoyant 24 months, regional neighbourhood shopping centres appear to be stabilising. Sales data from the past year indicate that the market for this asset class reached its peak during 2022 and early 2023. Since then, yields have softened through mid to late 2023 and early 2024 and are stabilising. Achievable yields have decreased by 0.5% to 1.50% from prices being achieved in 2021 and 2022. Demand has remained strong despite the significant interest rate rises through 2023. Yield compression was notable through the first half of 2022, driven by low interest rates and escalating construction costs. However, yields for investment properties firmed to historically low levels during late 2022 and early 2023 before correcting due to RBA interest rate increases during mid to late 2023.

Stability

Regional neighbourhood shopping centres continue to attract investors due to the strong lease profile the anchor supermarkets provide. Supermarkets offer strong cash flows and secure terms, being classed as ‘essential retailers’ with their turnovers aligned with inflation. However, there does appear to be a stabilisation of turnovers across supermarket providers after the ‘COVID’ boom.

Emerging Concerns

Potential buyers are increasingly cautious due to the rising trend of rental arrears and vacancies among specialty tenancies. This caution stems from anticipated declines in discretionary spending, driven by the escalating cost of living and higher interest rates. Centres featuring a higher proportion of specialties, including essential retailers such as chemists and medical centres, are currently viewed more favourably than those with a larger share of discretionary spending tenancies. ABS June quarter data noted that discretionary spending decreased 0.5% month-on-month, driven by reduced spending on recreational and cultural services, accommodation, and catering.

Barriers to Entry

After a period of uncertainty around construction costs, increasing land costs, rising debt costs for development, and extended development timeframes, there are very few proposed / new large neighbourhood shopping centres on the horizon. Existing centres are attractive to investors due to their established trade and tax depreciation advantages. Due to ongoing population growth and barriers to entry, existing centres will remain attractive to investors.

Recent Sales Highlights

Notable recent sales in regional New South Wales include Huntlee Shopping Centre, which sold for $33 million in December 2023 to a private investor, reflecting an analysed market yield of 5.77% and a weighted average lease expiry (WALE) by income of 7.75 years.

Northgate Tamworth recently sold for $18.3 million to a property trust, reflecting an analysed market yield of 6.55% with a WALE of 6.09 years. In contrast, 2022 sales at Cameron Park and Ormeau, which reflected yields of 4.49% and 4.93%, respectively, were considered to be at the peak of the market.

Current Market Listings

There are currently several listings throughout the East Coast, with agents reporting good levels of enquiry by a mix of purchasers, including high net-worth individuals and syndicates and trusts active in the higher value quantum space. There are currently four active listings in regional NSW, including the Leeton Plaza and Centennial Plaza at Cooma, both of which were purchased in 2022 and will provide a good indication of where the market currently sits to the perceived peak of 2022.

Error: Unable to load Block variation: showperson