National Disability Insurance Scheme (NDIS)

The purpose of the National Disability Insurance Scheme (NDIS) is to provide reasonable and necessary funding to people with a permanent and significant disability so that they may access the supports and services they need to achieve their goals. Participants receive individual budgets from which they choose the providers to support them.

The NDIS is administered by the National Disability Insurance Agency (NDIA). The Scheme was legislated in 2013 and began with several trial sites across Australia. The trial finished in July 2016 and the full Scheme began rolling out across Australia.

Specialist Disability Accommodation (SDA)

Specialist Disability Accommodation (SDA) refers to accommodation for people who require specialist housing solutions, including to assist with the delivery of supports that cater for their extreme functional impairment or very high support needs.

Funding is only provided to a small proportion of NDIS participants with extreme functional impairment or very high support needs who meet specific eligibility criteria.

SDA funding under the NDIS has stimulated investment in the development of new high quality dwellings for use by eligible NDIS participants. SDA funding is not for support services but is instead for the homes in which these services are delivered.

NDIS funding for SDA is attached to a participants plan, and it is portable. That is, participants will have the ability to move between accommodation providers and their funding will also move.

There are around 4.3 million Australians who have a disability. Within the next five years the NDIS will provide an estimated 500,000 Australians who have permanent and significant disability with funding for supports and services. For many people, it will be the first time they receive the disability support they need.

In its review in early 2019 the Federal Government reiterated the commitment to SDA being for around 28,000 people with disability in NDIS. This number is growing.

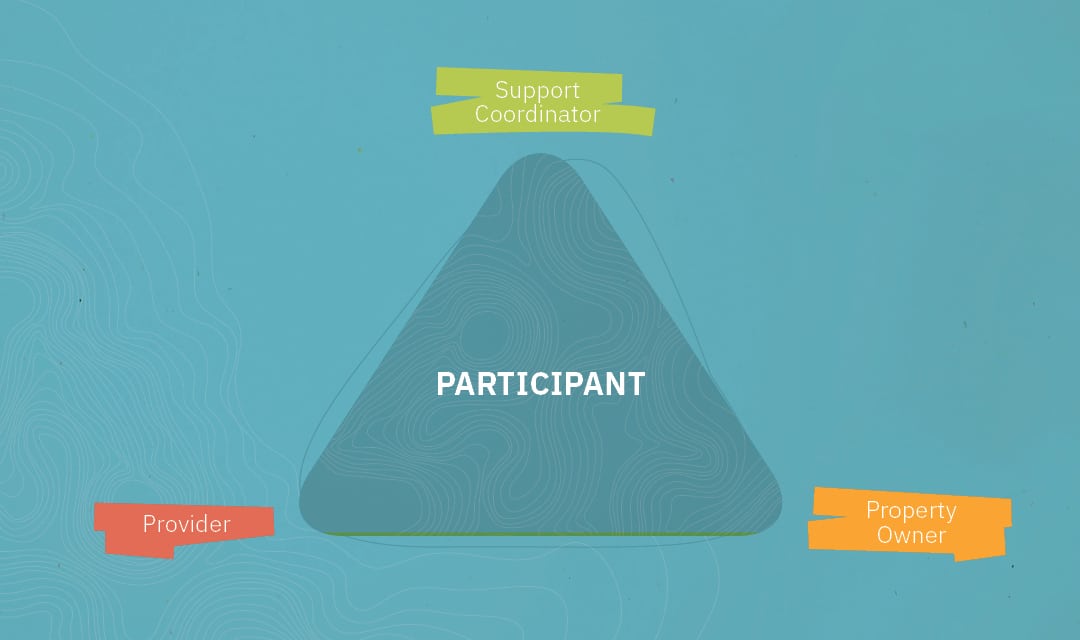

NDIS essentially involves 4 proponents:

- Participant - person access to funding (potential tenant).

- Support Coordinator – assists Participant to plan / apply for funding.

- Provider - an approved provider of Specialist Disability Accommodation (SDA). The NDIS has a list of Registered providers.

- Property Owner – the owner of the SDA

A provider has access to approved Specialist Disability Accommodation and a Support Coordinator has a client base including persons with access to NDIS funding for rental support for a room/unit within approved SDA.

SDA Design Categories

- Basic – Location and features that cater for the needs of people with disability. Only applies for Existing Stock or Legacy Stock.

- Improved Liveability – Silver level. It incorporates a reasonable level of physical access and enhanced provision for people with sensory, intellectual or cognitive impairment. Should include one or more of: luminance contrasts, improved wayfinding and/ or lines of sight.

- Fully Accessible – Platinum level. It incorporates a high level of physical access provision for people with significant physical impairment. Incorporates outdoor private areas accessible by wheelchair, vanity and handbasin accessible in seated or standing position, power to doors and windows (blinds), for retrofit of automation as necessary and consideration for the kitchen sink, cooktop, meal preparation bench and key appliances to be accessible in seated or standing position.

- Robust – Silver level. It incorporates a high level of physical access provision and be very resilient, while reducing the likelihood of reactive maintenance and reducing the risk to the participant and community. Includes high impact wall linings, fittings and fixtures, secure windows, doors and external area, appropriate sound proofing and laminated glass. Requires a retreat for staff and other residence if required and give consideration to adequate space and safeguards throughout the property accommodating the needs of residents with complex behaviours.

- High Physical Support. It incorporates high level of physical access for people with significant physical impairment. Requires wheelchair access, all bathroom and kitchen fittings and appliances to be accessible in seated or standing position, power supply to doors and windows (blinds), for retrofit or automation if necessary. Structural provision for ceiling hoists, assistive technology ready, heating/cooling and household communication technology (video / intercom systems), emergency power solution to cater for 2 hour outage, doors with 950mm clear openings.

SDA Market

The SDA sector appears largely immune to the volatility experienced in some markets through 2020 and on this basis, it appears to be a good sector to be invested in. However, the hurdles to successful Specialist Disability Accommodation development have been significant.

The key to success is matching qualified participants with approved providers of specialist disability accommodation. Approaches have been varied, from ad hoc to well managed and controlled. Some early adopters took the initiative to build SDA without detailed consultation with participants and providers which resulted in inadequate housing. More recent examples sighted are more appropriate in design and this has resulted in good take up by participants.

Over time the approval processes for participants and providers has improved, however remain difficult and specialists support coordinators are evolving in the role of matching participants with providers. Providers can act somewhat like a property manager in a real estate agency; however, most have a broader advisory role and are an essential player with legislation requiring them to be registered.

SDA falls into a segment of the investment market that can be defined as “impact investing”. Impact investing refers to investments that are made with the intention to generate measurable, beneficial social or environmental impact alongside a financial return.

Key Challenges for Investors

There are a number of operating models that are available to industry participants and each of these require different investment considerations. Understanding these is paramount to identifying the appropriate investment return applicable. The two predominant models are noted as follows:

- Lease between property owner and provider at agreed fixed annual rent.

- Agreement between property owner and provider with rent (revenue) tied to the cashflow generated from the property.

In many instances ,value expectations are unreasonable and based on speculation from ill-informed sources. At the core of the SDA market are the Participants. The key value driver for SDA is occupancy rates. With generally no more than 4 or 5 Participants residing in a property, the cashflow is very sensitive to vacancies. For this reason, new or proposed SDA carries a higher level of risk than a property that has successfully attracted Participants and provides a proven revenue stream.

With limited transactional evidence to draw upon at this point, sector participants must weigh up these opportunities against other asset classes and adjust their risk appetite accordingly.

1 (National Disability Insurance Agency, 2020), 2 (National Disability Insurance Agency, 2021)