Is the Aussie Dream Still Within Reach?

Owning your own home has long been part of the Australian dream. For many, buying a first home remains a major life goal, but it’s becoming increasingly difficult to achieve. With rapidly rising median house prices and limited supply, stepping onto the property ladder for the first time is daunting.

Using the latest data from Cotality in May 2025, let’s explore market trends and offer insights that might help first-home buyers navigate the challenges ahead.

Australia’s Housing Market - High Prices, Low Supply

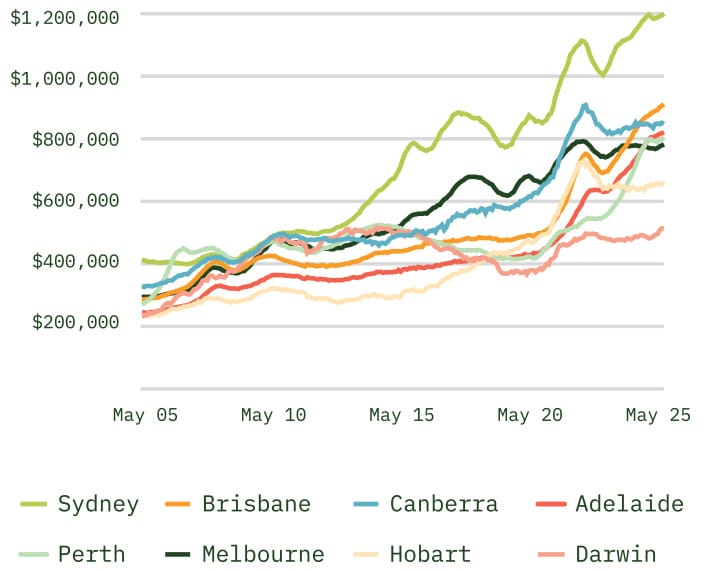

Home values across Australia continue to climb. According to May 2025 data from Cotality, the national median dwelling value now sits at $831,000, with most capital cities reporting median prices above $800,000.

Median Dwelling Values

Interestingly, in many cities more affordable homes at the lower end of the market have experienced stronger value growth than the broader market. This reflects strong demand for entry-level properties. Sydney bucks this trend, with high-end properties growing at a faster rate than the more affordable end.

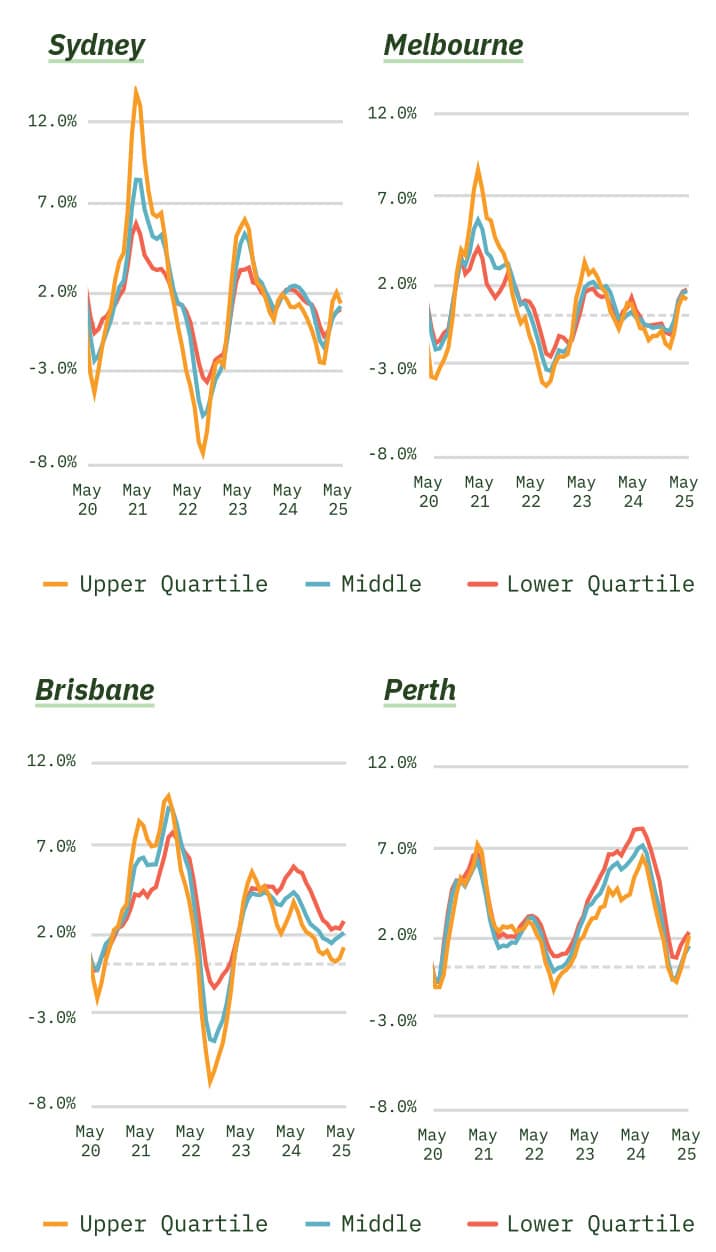

Quarterly Change in Dwelling Values

In the past year, the outer fringes of major cities have shown the strongest growth, areas often more attainable for first-time buyers, but now seeing increased competition.

A Shortage of Homes

What’s behind the ongoing price pressure? Simply put, supply isn’t keeping up with demand.

- Dwelling approvals are down 13% compared to the decade average (as of April 2025).

- Listings remain low due to seasonal trends and softer market sentiment.

- Investor activity remains strong, adding further competition for limited stock.

This shortage makes it especially difficult for first-home buyers to find properties within their budgets.

The First Home Buyer Challenge

Affordability

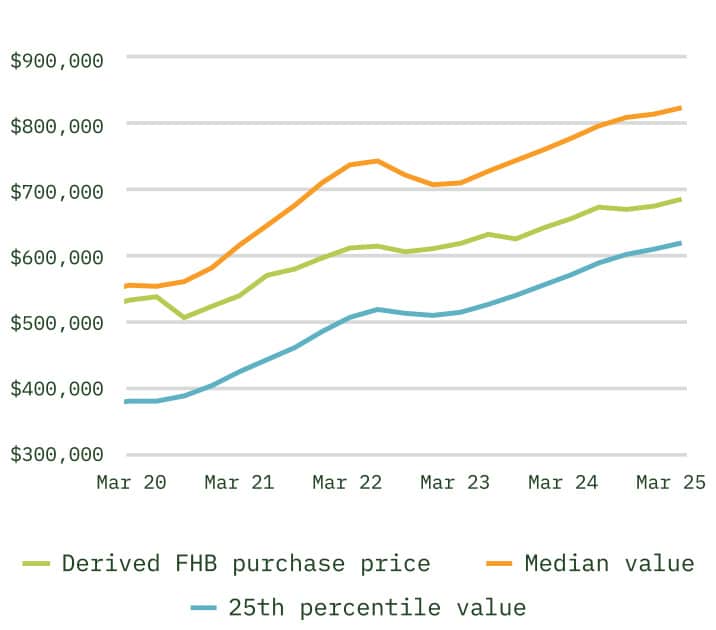

Affordability is now the biggest barrier. Median home values have surged well beyond what many first-home buyers can realistically afford.

The graph below shows that over the past five years, median property values, including entry-level homes, and the average first home buyer (FHB) purchases have increased by hundreds of thousands of dollars, making saving for a deposit tougher than ever.

Derived FHB Purchase Estimate Versus Median and 25th Percentile Home Value

High Rents

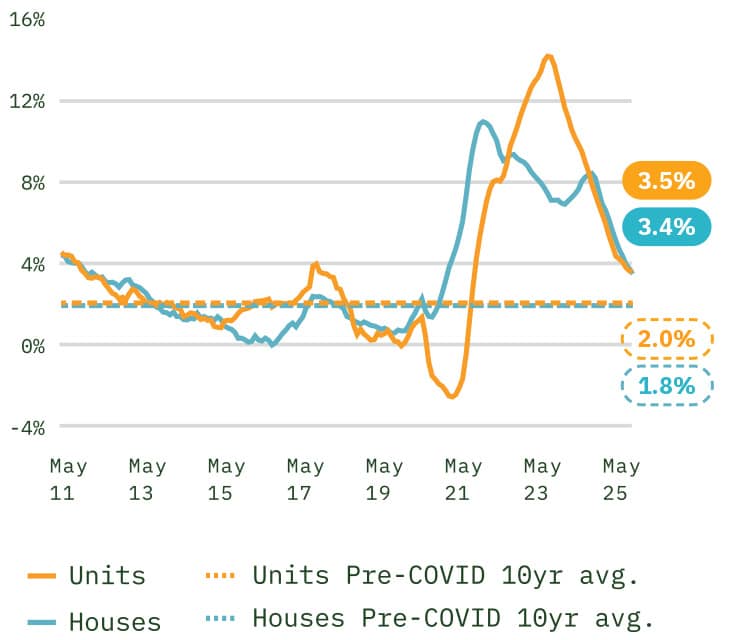

Rising rents add to the challenge by limiting how much buyers can save. While rental growth is slowing, it’s still growing with rents remaining above pre-COVID averages and appearing to be stabilising at these elevated rates

- Unit rents are up 3.5% (down from the peak of 14% in April 2023). The median weekly rent for units is $628.

- House rents are up 3.4% (down from 10.8% at the peak in 2021). The median weekly rent for houses is $676.

Rolling Annual Change in Australian Rents

Even if property prices continue to rise, with more interest rate cuts expected, the gap between rent and mortgage repayments is narrowing, potentially making ownership a more viable long-term option.

Median Weekly Mortgage Versus Median Rent - Australia Wide

Deposit Hurdles & Debt Concerns

- The household savings ratio has dipped to 5.2%, below the long-term average of 7.4%

- It now takes approximately 10.6 years to save a 20% deposit on a median-priced home, assuming 15% of income is saved annually.

- Household debt remains high, with housing debt making up around 74% of total household debt.

- The share of income needed to service a new mortgage is 50.5%, higher than the 10-year average of 36.8%, based on an 80% loan over 25 years at current variable rates.

Despite small improvements in borrowing power, affordability metrics still reflect some of the most challenging conditions on record for median-income households.

“Trying to save a deposit while prices kept changing was the toughest part of buying my first home.”

– Recent First Home Buyer

Support & Grants for First Home Buyers

First home buyer activity often peaks when temporary government grants and schemes are introduced, highlighting just how valuable this support can be. Fortunately, there are now several ongoing and uncapped government initiatives designed to tackle two of the biggest barriers to entry, saving for a deposit and covering upfront costs like stamp duty. These programs aim to reduce the financial pressure and help eligible buyers secure a first home sooner.

- First Home Guarantee (FHBG)

Part of the Federal Government’s Home Guarantee Scheme, this initiative lets eligible buyers purchase a home with just a 5% deposit and no Lenders Mortgage Insurance, with up to 15% guaranteed to reduce upfront costs. Buyers must be Australian citizens or permanent residents, aged 18+, earning up to $125,000 (individual) or $200,000 (joint), and planning to live in the home. Applicants must not have owned property in the past 10 years. Property type and price caps apply based on location. - First Home Owner Grant (FHOG)

A national scheme providing a one-off payment to eligible first homeowners toward the purchase or construction of a new home.

| State/Territory | Grant Amount | Eligibility Highlights |

| Queensland (QLD) | $15,000 or $30,000 | New homes or owner-built homes; must be principal place of residence (PPR). |

| New South Wales (NSW) | $10,000 | New or substantially renovated homes valued up to $750,000; must be PPR. |

| Victoria (VIC) | $10,000 | New homes valued up to $750,000; must be PPR. |

| South Australia (SA) | $15,000 | New homes; no value cap |

| Western Australia (WA) | $10,000 | New homes; must be PPR. |

| Tasmania (TAS) | $30,000 (for eligible transactions between 1 Jul 2024 and 30 Jun 2025) | New homes; must be PPR. |

| Northern Territory (NT) | $50,000 (for new homes); $10,000 (for established homes) | New homes or established homes; must be PPR. |

| Australian Capital Territory (ACT) | FHOG replaced by Home Buyer Concession Scheme; stamp duty concessions available | Stamp duty concessions for eligible first-home buyers. |

Please note that eligibility criteria, property value caps, and other conditions may apply. It’s advisable to check with the relevant state or territory revenue office for the most up-to-date information.

- Stamp Duty Concessions

Many states offer full or partial stamp duty exemptions for eligible first home buyers, significantly reducing upfront costs.

| State/Territory | Stamp Duty Concession Details |

| Queensland (QLD) | Full exemption on new homes and land from 1 May 2025, no value cap. |

| New South Wales (NSW) | Full exemption up for homes to $800k land to $350K; concessions for homes up to $1M, land $350-$450K. |

| Victoria (VIC) | Full exemption up to $600k; concessions up to $750k. |

| South Australia (SA) | Full exemption on new homes from 13 Feb 2025, no value cap. |

| Western Australia (WA) | Full exemption up to $500k; concessions up to $700k in metro & Peel region, $750k in all other regional areas. |

| Tasmania (TAS) | Full exemption on homes up to $750k (18 Feb 2024 – 30 Jun 2026). |

| Northern Territory (NT) | Concessions available; details vary. |

| Australian Capital Territory (ACT) | Means-tested concessions up to $34,270 under Home Buyer Concession Scheme for all property types. |

- Superannuation Access through the First Home Super Saver Scheme (FHSSS)

This scheme allows eligible individuals to make voluntary contributions to their superannuation, up to $15,000 per year and $50,000 total, to help save for their first home. These contributions benefit from lower tax rates and can be withdrawn, along with associated earnings, to use towards a home deposit. - State-Based Incentives and Shared Equity Options

Some states also provide shared equity programs or low-deposit loan schemes aimed at supporting lower-income buyers or essential workers.

Key features generally include:

- The state government contributes a percentage of the purchase price (typically 20–30%) in exchange for an ownership stake.

- Buyers need a smaller deposit (sometimes as low as 2%).

- No interest or repayments are usually required on the government’s share while the property is owned and lived in by the buyer.

- The government’s share is repaid when the property is sold or if the buyer chooses to buy out the stake.

Availability, eligibility criteria, and property price caps vary by state. Participating states currently include Victoria (Homebuyer Fund) and Western Australia (Shared Home Ownership Program), Queensland (Boost to Buy) with others offering similar assistance under different schemes.

First home buyers should check their state’s housing department website or speak with a lender for up-to-date information.

Valuation Support for First Home Buyers

A property valuation can be a helpful step for first home buyers, offering a clearer picture of a home's value and supporting informed decisions. Whether you're buying off-the-plan, building, or purchasing an established property, a valuation can help ensure you're not paying more than it's worth.

Buying your first home can be challenging, but with the right support and a clear understanding of value, you can make informed and confident decisions in today’s market.