The Sydney Metro West project is set to deliver a new underground railway connecting Greater Paramatta and the Sydney CBD, with the aim of doubling rail capacity.

Project planning commenced in 2019 and the project is expected to be complete by 2030.

Key details

- In May 2021, Sydney Metro announced plans to acquire and withdraw 41,500m2 of office stock (26,100m2 freehold and 15,400m2 strata) by the end of 2022.

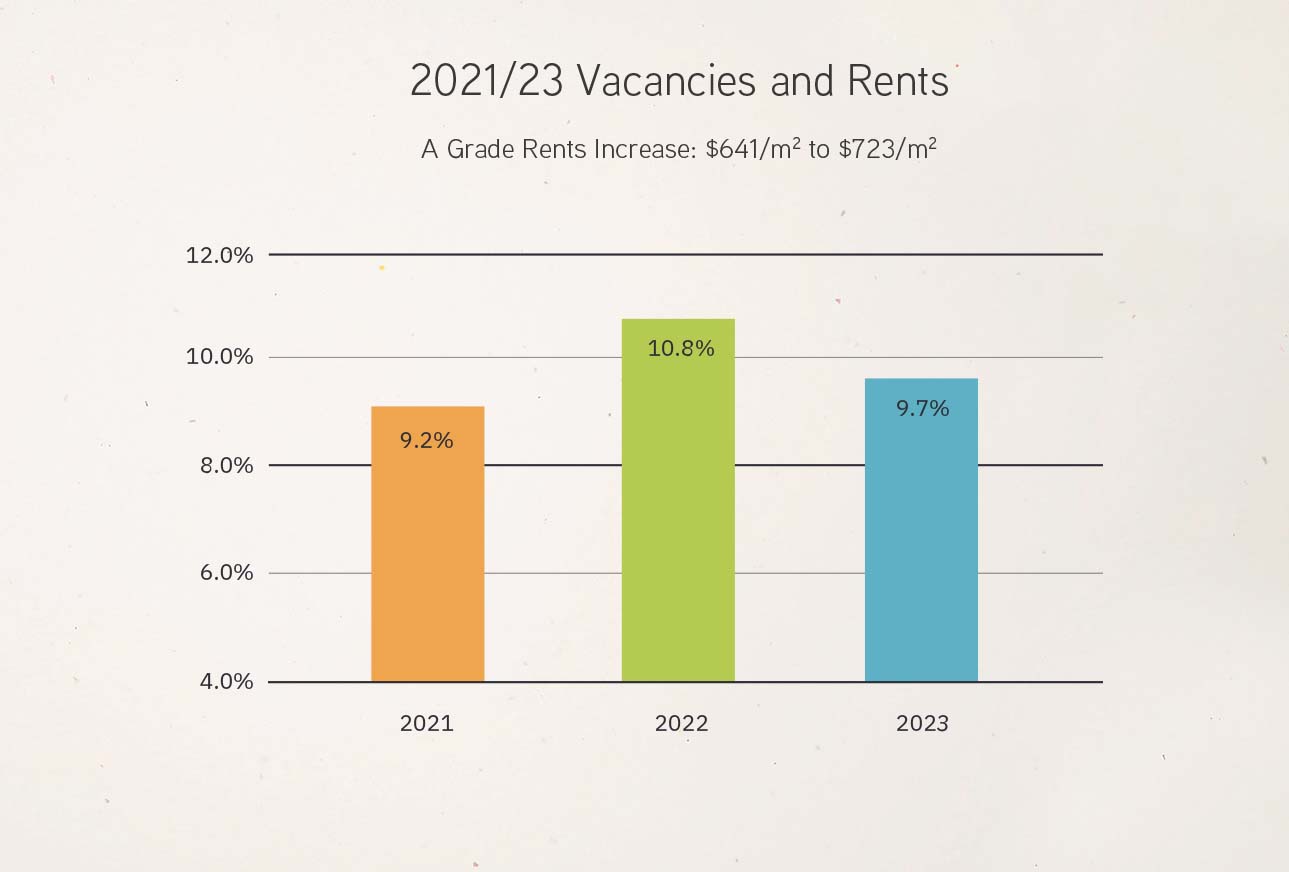

- The withdrawal of office stock is set to reduce Sydney CBD office vacancies from 10.1 % to 9.7% by June 2023 (40bps decline).

- Rental growth will emerge from 2022/23, driven by expanding white collar employment and the office stock withdrawals.

- Stock withdrawals will support strong capital appreciation across the City Core strata market. Acumentis considers that prime strata benchmarking pricing of $23,000 - $25,000/m2 will be achieved during the Sydney Metro West acquisition phase.

Acquisition set to reduce CBD office and strata property

In May 2021, the NSW Government announced that it will compulsorily acquire 11 properties in the CBD, and two more in Pyrmont, to make way for construction of a Metro station, due in 2030.

The project will displace around 26,100m2 freehold and 15,400m2 strata space. Owner and occupiers will need to vacate their premises by late 2022.

Now that Metro has commenced its acquisition process, the experts at Acumentis take a deeper look into the impact upon the Sydney CBD occupier and strata markets.

Historic impacts

This is not the first time that Sydney Metro development has impacted Sydney CBD office markets.

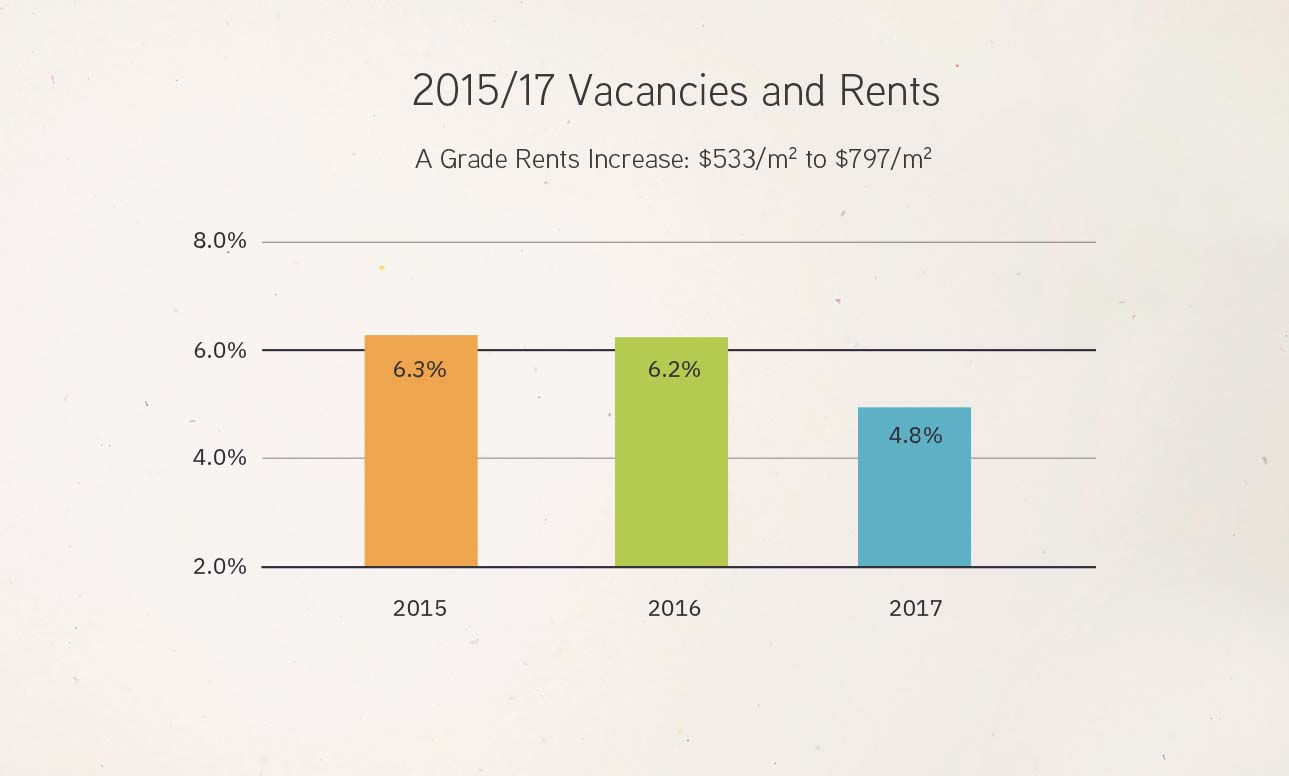

Over 2015-17, Sydney Metro acquired and withdrew some 54,000m2 of space – with an additional 140,000m2also withdrawn to accommodate new office and residential development.

By 2015 occupier markets were beginning to stabilise after a prolonged downturn. Accordingly, stock withdrawals, along with expanding tenant demand, ignited the market.

Over 2015-17 total CBD vacancies declined from 6.3% to 4.8% however, the impact upon rents was substantial with A Grade effective rents rising by 50% over this period.

These priorities will differ between family members so it’s important to capture them and understand their priority for each family member before options are explored for succession.

The forecast - A more moderate impact on CBD office market

We forecast that vacancies will reach 9.7% by Jun-23 with 40bps of this decline associated with Sydney Metro West stock withdrawals.

These conditions, along with expanding white-collar employment, should start to support effective rental growth from 2022 – the first time since the onset of the COVID-19 pandemic. We forecast that A Grade rents will grow by 13% over this period.

Our early read is that displaced occupiers will try to remain within the City Core precinct. Accordingly, we expect that the City Core will outperform the broader market.

The forecast - Substantial impact on the strata market

Sydney Metro West plan to acquire and remove 15,400m2of strata office space by the end of 2022.

This represents 8% of the City Core strata provision or the equivalent of 1.2x of annual strata trading volumes.

Again, we believe that these displaced strata owners will try to remain in the City Core precinct. Agents are reporting that a potentially larger buyer pool and lack of trading stock is pushing strata pricing.

Tightening supply/demand metrics supports the investment case for capital appreciation. We believe prime pricing will increase from currently $18,000 - $20,000/m2 to $23,000 - $25,000/m2 during the Metro acquisition programme.

Market conditions now may be supportive of a new strata office development – something that has not happened since 2013. In an upcoming paper Acumentis will explore the scope of new strata development in the Sydney CBD.