After a period of dormancy during 2019/2020 the market for licensed hotels in Queensland sprung to life throughout 2021 continuing into 2022. Transaction volumes have increased with competitive tension developing across the market for better quality assets.

The strength and significant uplift in values in the southern markets, particularly New South Wales, has prompted many southern-based buyers to look to Queensland for opportunities that generally offer better returns. At the same time, locally-based buyers are seen to be expanding their footprint. The low cost and comparatively ready availability of finance are also helping to promote buyer interest.

The COVID-19 pandemic undoubtedly impacted the Queensland licensed hotel market with all licensed venues required to close from March 2020 to June 2020 with restrictions for staff and patrons ongoing through 2021 and the early part of 2022. However, a ‘silver lining’ for many hotels has been the significant uplift in the financial performance of their gaming machines (pokies).

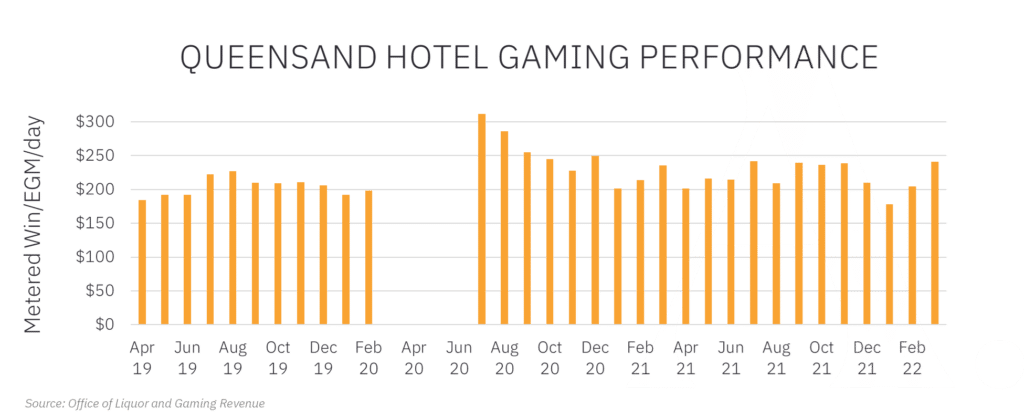

Gaming revenue spiked considerably after the re-opening of Queensland licensed hotels in June/July 2020, as evidenced by the chart below showing average daily metered wins per machine across Queensland’s hotels:

Factors that initially contributed to the uplift in gaming performance of gaming venues include the various Government welfare support programs, such as JobSeeker and Pandemic/COVID-19 Disaster payments, providing additional disposal income, particularly to those not in employment, and the limited opportunity for travel or recreational activities due to COVID restrictions leading more patrons to attend venues with gaming machines for entertainment.

Whilst the advent of the OMICRON variant impacted revenue levels in December 2021, they have once again rebounded over the 2022 year to date. Average daily metered wins per machine levels have increased by approximately 10.6% from $176 in March 2021 to $195 in March 2022.

Whilst gaming revenue across the whole of Queensland has increased from pre-pandemic levels, there is some segmentation in the market with South East Queensland venues experiencing much stronger uplift in comparison to their Northern and Western Queensland counterparts as demonstrated in the table below:

| Change in Average Metered Win/Machine/Day | ||

| Region | Mar 22 to Mar 21 | Mar 22 to Mar 19 |

| Brisbane LGA | 19.6% | 19.0% |

| Logan LGA | 20.6% | 31.2% |

| Moreton Bay LGA | 17.7% | 26.3% |

| Ipswich SA | 20.5% | 30.3% |

| Gold Coast SA | 15.3% | 27.8% |

| Sunshine Coast SA | 0.3% | 14.8% |

| Toowoomba SA | 15.7% | 35.5% |

| Darling Downs – Maranoa SA | 11.5% | 28.1% |

| Wide Bay SA | 9.6% | 25.7% |

| Central Queensland SA | 0.9% | 18.8% |

| Mackay/Isaac/Whitsunday SA | 0.8% | 22.9% |

| Townsville SA | -11.4% | -2.7% |

| Cairns – SA | -1.3% | 15.2% |

| Qld Outback SA | -4.9% | 2.3% |

| Whole of Queensland | 10.6% | 20.9% |

*LGA – Local Government Area SA – Statistical Area

Source: Office of Liquor and Gaming Revenue

Of note is the strong uplift recorded in the Toowoomba SA with the Townsville SA conversely recording negative growth. This is a surprising contrast given that these are Queensland’s two largest regional centres with reasonably similar demographic profiles.

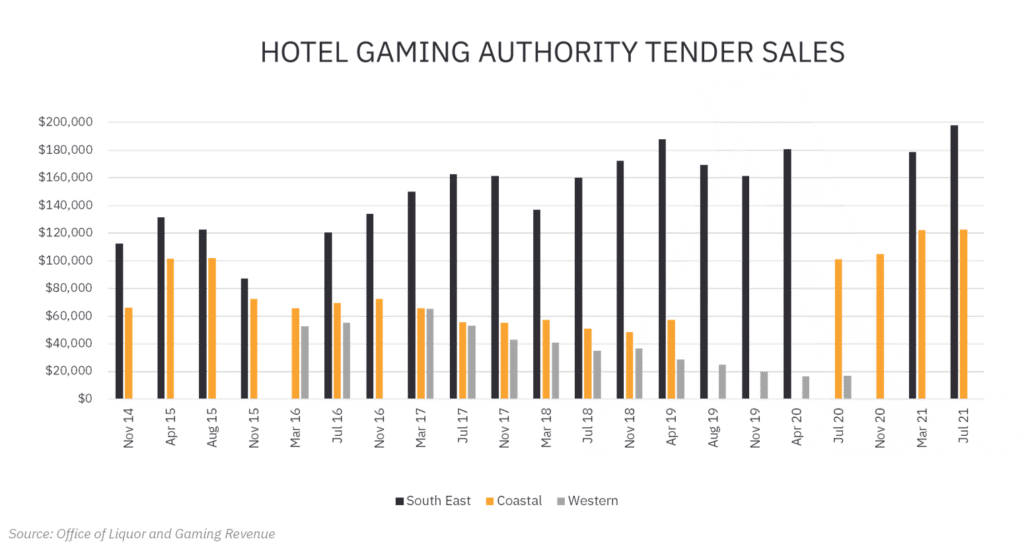

The improved returns being derived from gaming have manifested in recent tender results for gaming operating authorities:

Queensland is divided into three regions the South East Region, the Coastal Region, and the Western Region. Gaming operating authorities can only be sold within the region they are located. Operating authorities are offered for sale by tender, conducted by the State Government (Public Trustee) two to three times a year with the average price achieved in each region being distributed to the respective vendors. A commission of 33% is payable to the State Government upon sale.

The improved returns from the majority of the State’s gaming machines have resulted in comparatively limited volumes of operating authorities being offered up for sale. Prior to the onset of the pandemic, an average of 67 operating authorities were offered at the tenders held from November 2014 to November 2019. Over the four tenders held since April 2020, the number of operating authorities offered has averaged just 39. Of note is that only 32 Coastal regions and no South East or Western region operating authorities were offered to the market in the most recent tender in July 2021.

The improved financial performance and limited availability of operating authorities have resulted in a significant spike in their values which is readily identified in the graph above. The strong growth in values for Coastal authorities reflects that this region includes some of the areas recording the strongest growth in gaming performance.

In summary, the improved performance of gaming in Queensland is enhancing returns from many Queensland licensed hotels and stimulating market interest. Despite the widespread lifting of COVID-19 restrictions and the end of many of the welfare support programs, gaming performance, at this stage, appears to be holding at levels in excess of those achieved pre the pandemic. The significant spike in the value of operating authorities, and their limited availability, is creating an impediment to new competition and underpinning the value of licensed hotel assets. As a result, buyers currently have greater confidence in investing in licensed hotels in Queensland than they have for many years.