Exploring Queensland’s 2023 Accommodation Trends: Insights on Occupancy Rates, RevPAR, and ADR from the Latest TEQ Report

In our January edition, Acumentis explored the trends among domestic overnight visitors in Queensland, noting a slight increase in occupancy rates for 2023. This time, we explore the recently released "Queensland Accommodation Report" by Tourism and Events Queensland, which provides an overview of the state's accommodation sector's performance, reviewing occupancy rates, revenue per available room (RevPAR), and average daily rates (ADR) for establishments with ten or more rooms.

Here are the highlights from the March 2024 report.

Performance Highlights

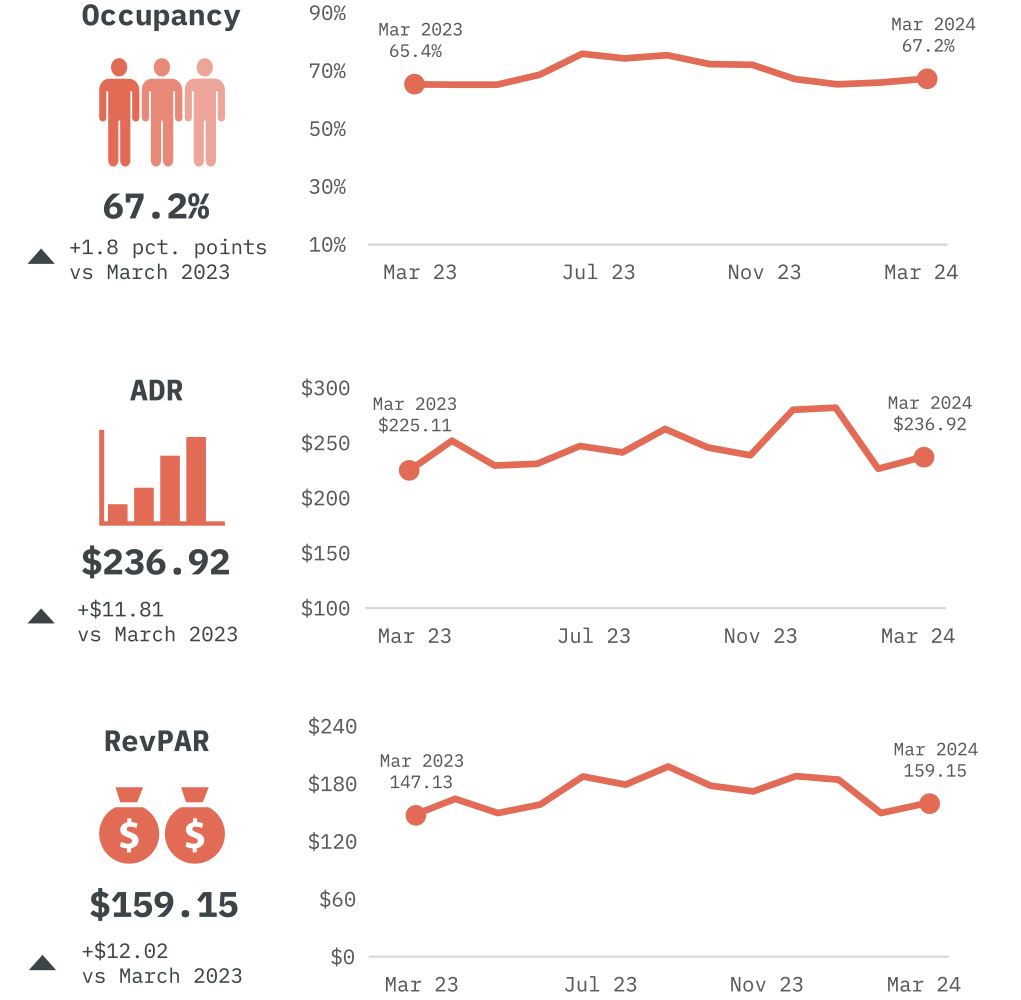

Queensland’s accommodation sector reported an occupancy rate of 67.20% in March 2024, 1.8% increase compared to March 2023. The average daily rate (ADR) also increased, coming in at $236.92, which is $11.81 higher than the same period last year. Similarly, RevPAR increased to $159.15, up from March 2023’s $147.13. This performance was boosted by the seasonal timing of Easter, which was in April the previous year. The performance metrics for March 2024 also exceeded pre-COVID-19 levels from June 2019 cross occupancy rates, ADR, and RevPAR.

Regional Insights

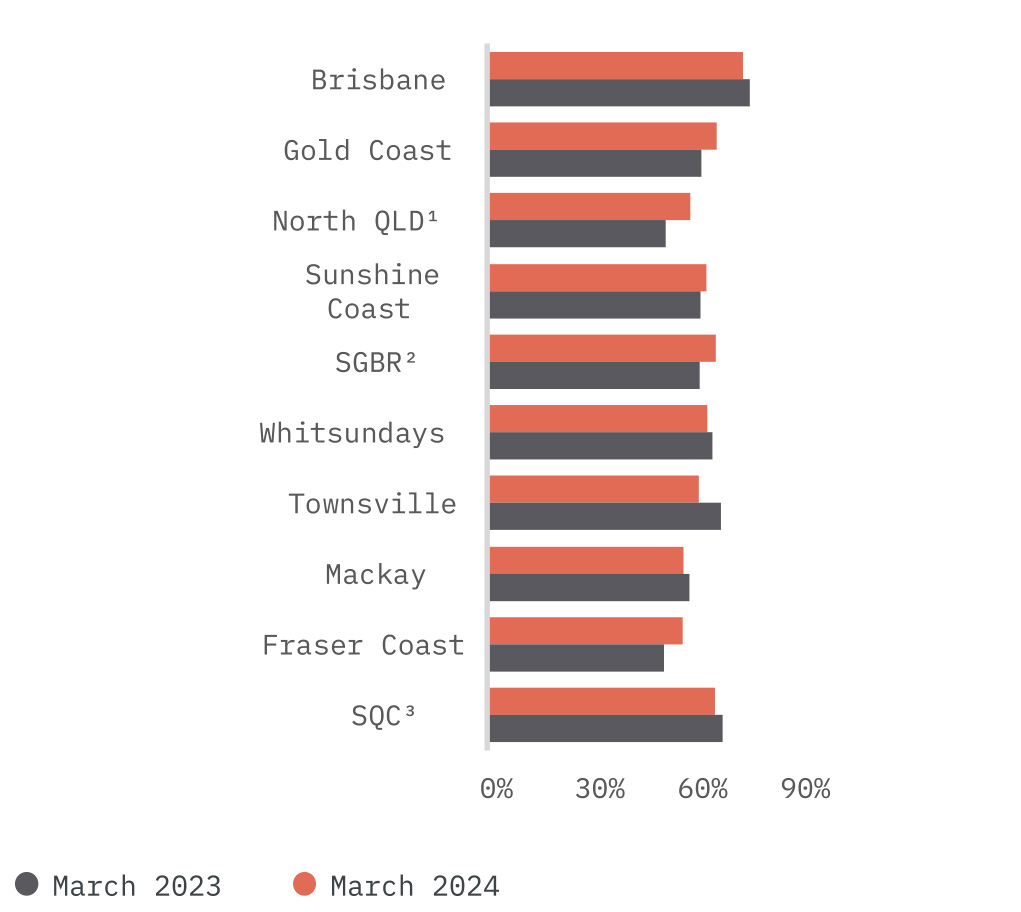

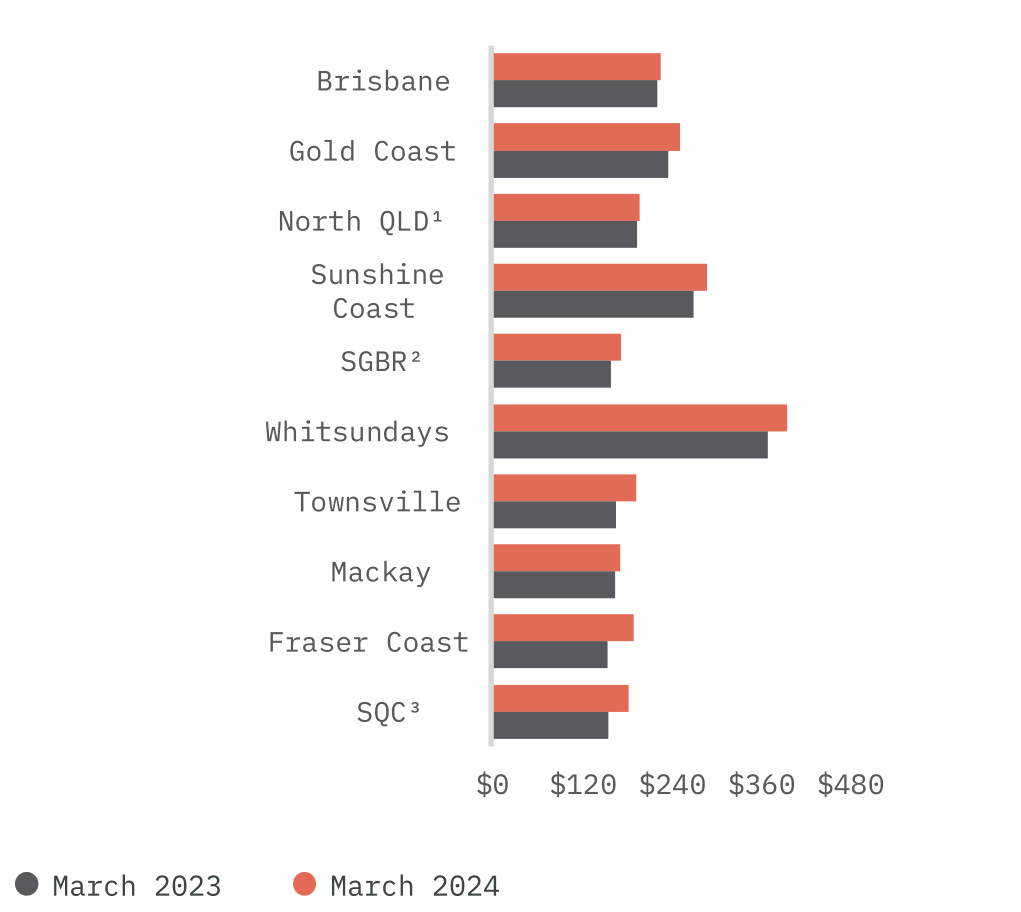

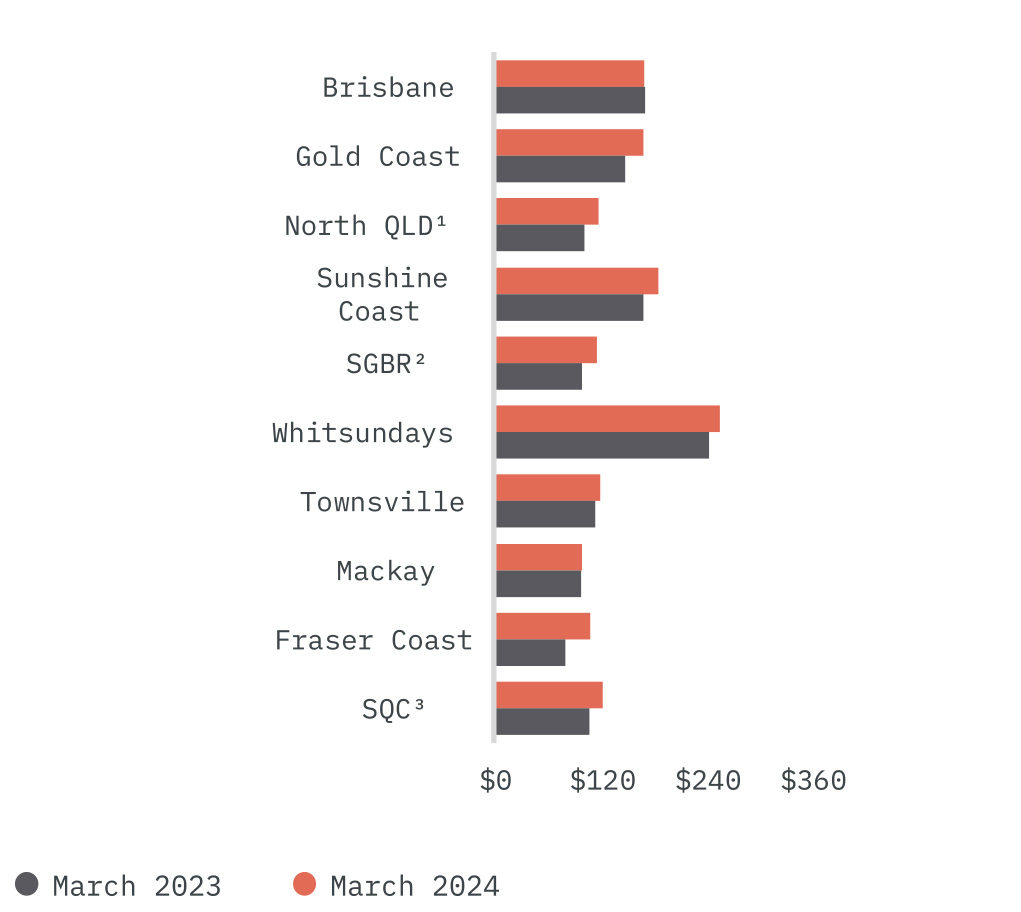

Many regions, the Fraser Coast, Gold Coast, Southern Great Barrier Reef, Sunshine Coast and Tropical North Queensland, reported stable to stronger occupancy rates, ADR, and RevPAR compared to March 2023.

Occupancy by region

ADR by region

RevPAR by region

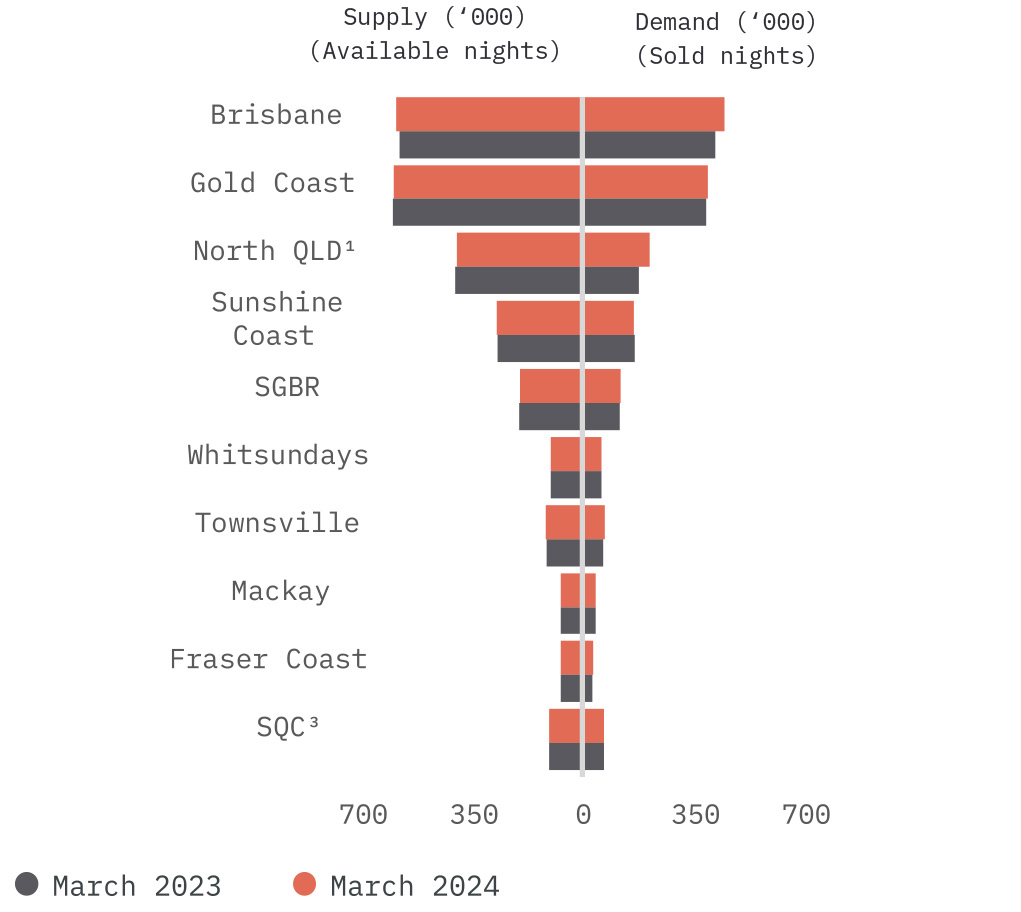

Supply/demand by region

STR provides data benchmarking and analytics for the global hotel industry (www.str.com/aam)

ADR (Average Daily Rate) – Room revenue divided by rooms sold, displayed as the average rental rate for a single room

Demand (Rooms Sold) – Rooms sold in a specified time period

Occupancy (per cent of Available Rooms Sold) – Rooms sold divided by rooms available multiplied by 100

RevPAR (Revenue Per Available Room) – Room revenue divided by rooms available

Supply (Rooms Available) – Rooms multiplied by the number of days in a specified time period

2 SGBR – Southern Great Barrier Reef

3 SQC – Southern Queensland Country

Leasehold and Freehold Market Trends

The leasehold interest market for regional motels in NSW is strong, with purchasers actively seeking high-quality motels featuring industry-standard lease covenants and affordable rentals. Inland motel sales have traditionally shown yields of 28% to 33% for quality assets, but recent sales indicate a tighter range of 25% to 30%. Coastal assets, similarly, have seen yields narrow from 23% to 28% to a current range of 20% to 25%. Demand is strong, with many purchasers being well-capitalised industry participants who often do not require financing.

Lessor Interest Trends

Yields for leased motels (Lessor Interest) persist within the 6.00% to 9.00% range, below historical ranges of 7.50% to 9.00%, despite rising interest rates. Several purchasers are strategically buying Lessor Interest assets with plans to consolidate the interests and operate the properties as Freehold Going Concerns in the future.

Queensland Market Activity

In Queensland, market activity has certainly increased, driven by southern-based investors seeking higher yields compared to other commercial property investments and similar motel investments in southern states. However, yield tightening has not yet occurred.

Outlook for 2024

Looking ahead, the focus in 2024 will be on navigating high inflation, tariffs, and rising operating costs, including insurance, electricity, and linen expenses, which impact net operating profits. Travellers are expected to continue supporting motels aligning with their values, but high inflation may temper growth.