Along with the growing need for valuations in Family Law matters, we are experiencing a significant increase in the number of valuation requests for Estate Planning purposes, particularly within blended families with the transfer of wealth a major concern.

The evolving structure of modern families, including the rise of blended families, adds layers of complexity to estate planning, with the distribution of assets after death now becoming quite complicated.

While traditional Wills provide a foundational framework, additional mechanisms such as Asset Trusts and Marriage Trusts have become increasingly vital. These trusts, including Family Trusts, Spendthrift Trusts, Marital Trusts and QTIP trusts, offer flexible solutions to navigate the dynamics of blended families.

Unlike the typical estate plan that primarily focuses on transferring assets to your spouse, these mechanisms accommodate the complexities arising from stepchildren, children from a previous marriage and even former spouses.

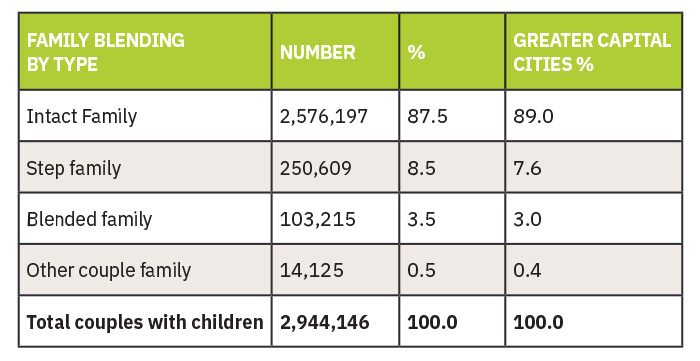

The latest census data from 2021 shows that one-third of all registered marriages now involve at least one previously divorced partner. It also reveals that a growing percentage of these marriages involve existing children from previous relationships. As such, the importance of sound estate planning is becoming more crucial to address the dynamics of blended families.

Property Valuation: A Strategic Tool in Estate Planning

At Acumentis, we recognise the pivotal role of property valuation in estate planning for blended families. Our comprehensive valuation services cater to various estate planning scenarios:

Current Value: Providing beneficiaries with an accurate current market valuation of property helps set realistic expectations and provides peace of mind when the property is being sold. This is often key when beneficiaries are spread though out the country or overseas and don’t understand the property market in the specific city or region.

A current market value may also be used if one of the beneficiaries wants to purchase the property outright from their siblings. Given the tightly held nature of the property market we’re seeing this happen more, particularly with older properties nestled in prime locations – the old house in the best street scenario.

Recently, I valued an untouched house in one of Brisbane’s oldest and most sought-after streets for this purpose. It retained original features like oil tanks and burners for lights- very cool!

Life Interest; Where an Estate Plan allows for a spouse or beneficiary to reside in the property until their passing. We calculate the property's value by deducting the impact of this rent-free occupancy from its current market value. Considering life expectancy data and potential income loss, we arrive at the property's net present value. Such a life Interest or tenancy arrangement can significantly impact the property’s overall value.

Currently, I’m valuing a property where the current value is around half of the market value if unencumbered by the Life Tenancy, due to the length of the tenancy.

Historical or Retrospective Value: Assessing property value at a past date to ascertain any tax implications including capital gains. Our expertise extends to complex portfolios, with valuations spanning multiple decades.

I recently completed the portfolio valuation of a Deceased Estate, conducting valuations dating back to 1994. My deep working knowledge of the property market spanning this period proved invaluable. It brought back memories of past markets!

Litigation: When a Will is contested by an eligible person under the Succession Act, we complete valuations for court purposes, our valuations serve as crucial evidence, providing clarity amidst legal disputes. This often includes Family Court matters where a property is bequeathed to a person involved with a family law separation event.

As a fully diversified valuation business, Acumentis is equipped to service diverse mixed property portfolios including residential, commercial and rural properties, alongside business valuations.

And of course, with our nationwide coverage and single contact point to streamline processes, we can arrange Estate Valuations across the country catering to the complexities of wealth transfer within blended families.