Central Queensland has experienced a significant upturn in the market for well-established, viable farming and beef cattle grazing properties in recent years. Despite economic challenges, high-quality properties continue to see strong demand driven by several key factors.

Key Market Drivers

The principal drivers of this noticeable upturn in the market were:

- Comparative low interest rates

- Improved commodity prices

- Limited supply

- Improved seasonal conditions.

However, over the past 18-24 months these conditions changed with:

- Rapid increases in interest rates, although rates are still historically low.

- Rapid decreases in beef, lamb and goat prices.

- Fluctuating grain and pulse prices.

- Pessimistic rainfall outlook at the end of 2023.

- Significant inflation of input costs.

Even though economic conditions have worsened, due to a lack of supply, quality properties are still selling strongly.

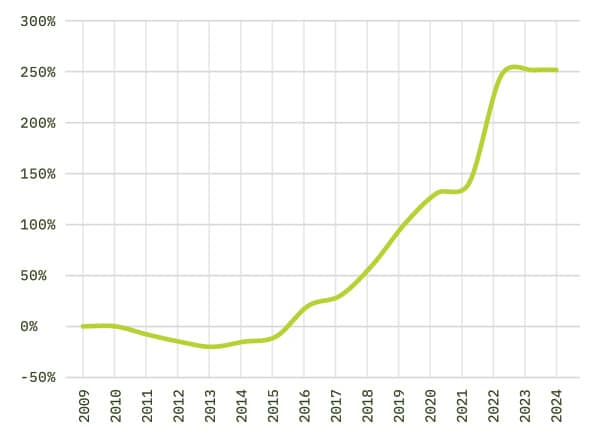

The graphs reproduced below illustrate our understanding of the market for dryland farming and cattle grazing properties in Central Queensland over the last 15 years.

Dryland Farming Values

Grazing Land Values

Dryland Farming Sales

There were three notable sales of good quality farming properties in well regarded locations in the latter half of 2024, including;

- Carnarvon View near Rolleston

- Eleanor Farm in the Kilcummin district (north of Clermont)

- Off-market sale to an adjoining owner in the Rolleston district

The sales ranged from $13.75 million to $19 million. After deducting the value of inclusions the sales showed a range in value of approximately $5,250/ha to $7,400/ha overall. The figures reflect a broad range due to differences in property size, location, soil types and the quality of the infrastructure on each of the properties. Purchasers were well-established local families, paying at or above the previously seen values for similar quality.

Grazing Property Sales

Central Queensland also saw a number of good quality grazing property sales in the latter half of 2024, with notable transactions including.

The Fairfield Aggregation, Bauhinia

Forming part of the Ray Scott Pastoral Company Dispersal Sale, there was significant anticipation about the sale of the Fairfield Aggregation. A large-scale aggregation of seven grazing properties in a good location with good quality country types. The properties ranged in size from 1,889ha to 10,655ha. Initially listed for sale via expression of interest. The properties were initially listed for sale via expression of interest in May 2024 before being scheduled for auction in October 2024. Five properties sold at auction or shortly after, with the remaining two selling about seven weeks later. The sales ranged from $12.5 million to $49 million showing a range in value of approximately $4,900/ha to $8,100/ha overall. Country types and level of development appear to be the key price driver. The top rate was achieved by the property with the best mix of country, including a small portion planted to leucaena, while the lower end of the range was achieved for larger properties with slightly inferior country types, albeit still considered good quality. All buyers were well established families from Central/Western Queensland, and the sales align with other sales in the district.

Hillcrest, Middlemount

The sale comprises, a 9,547ha grazing property with a good mix of brigalow scrub country that was reported to be run down and also impacted by significant potential flooding. After being passed in at auction, multiple offers were received. The final sale price appears to be towards the lower end of pre-auction expectations. This highlights that buyers are looking closely at the condition of properties, their level of development and potential environmental issues when making purchasing decisions, where previously they may have been willing to overlook these details to secure a quality asset.

Summary

In Central Queensland, while the pool of potential buyers appears to have reduced from previous levels seen in 2022. Good quality assets are still being met with strong competition at similar levels to previous years.