The latest quarterly changes in growth continue the flattening trend off the sharp escalations experienced in construction since the start of the pandemic. However, the industry is still facing significant challenges.

For those grappling with building projects and bearing the brunt of delays, cost increases in materials, labour shortages, and extended completion dates, there is now the additional strain of relentless interest rate rises and extreme rental market conditions influenced by price and availability of accommodation. These factors continue to exert pressure on the rising cost of materials and labour.

Can we expect any reprieve as we move through 2023?

Our research, based on conversations with industry colleagues, reveals a mixed bag of reactions and forecasts for the times ahead. When it comes to complex construction issues, there are multiple layers of problems to work through. However, our key observation is that the market will continue to be volatile and walk a tightrope of challenges.

1,672 construction companies have entered administration over the first 9 months of 2022/23, representing an 84% increase over the previous year.

Although we have seen a flattening of the curve over the past three quarters, there are still critical areas of concern that remain in place, such as:

- The overall health of the construction industry, which still faces cost pressures for various materials (albeit some supply chains have improved), ongoing labour issues, and delays in project completion. Demand for materials remains high due to the volume of work already in the pipeline.

- The fallout of these cost pressures is being felt within the industry, as figures released by ASIC indicate that 1,672 construction companies have entered administration over the first 9 months of 2022/23, representing an 84% increase over the previous year

- Residential construction activity is generally trending downwards across the country, primarily due to the Federal Government’s COVID homebuilder stimulus grants distorting demand. However, there is still strong underlying demand for housing and a concerning lack of supply.

- There continues to be pent-up demand for housing across the country in general. Although we may see a softening of the curve in the short term, building activity will need to accelerate in order to address the crippling housing shortage being experienced nationally.

House Construction Index Shows Growth

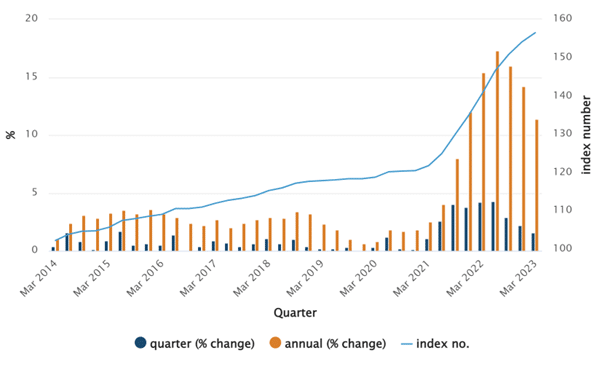

On a positive note, the ABS (House Construction Index) registered a quarterly growth rate of 1.6% for March 2033, compared to 4.2% in March 2022. Annually, we have recorded an increase of 11.4% compared to the peak of 17.3% recorded in June 2022. While this decrease provides some reprieve, given the many factors associated with the construction crisis this result could potentially be short-term.

Some builders are reporting that some materials are slowly becoming more available, with previous shortages now easing. For example, steel products have experienced a price fall (ABS March 2023). The rate of price increases has eased in the recent quarter (ABS March 2023) as the supply of building materials improved due to increased domestic production and imports. However, the most significant challenge remains sourcing sufficient skilled labour to satisfy demand and undertake the high volume backlog of work.

Ensuring Adequate Insurance Coverage

Looking ahead it is evident that the construction sector still has significant challenges. It is also evident that our property market in general will deliver change and a varied level of performance and activity.

In our work within the strata industry, owners and managers need to ensure that their property is accurately insured as this issue has become more challenging since the COVID pandemic. Prior to the pandemic, construction costs were relatively stable and the more common issue was deemed to be over-insurance due to automatic fixed percentage annual escalations applied to strata properties. In today’s landscape however, if you are not reviewing your position regularly, you may be significantly under-insured, which can have serious consequences.

In a volatile and rapidly changing market, it is best practice to assess your property insurance annually.

At Acumentis, we offer our clients independent professional advice and guidance with their property decisions based on our genuine care in helping them reach the best possible outcome that is right for them. By reaching out to the Acumentis team, we can assist you with all your property requirements and ensure you have adequate and up-to-date insurance coverage.