Unless you have been living under a rock, you’re likely aware of the unprecedented crisis that the building and construction industry has been facing.

This turmoil, which began with the onset of the COVID-19 pandemic in 2020, has been further exacerbated following Russia’s invasion of Ukraine in 2022 and, more recently, the Gaza conflict and attacks on Red Sea shipping routes. These global events have intensified supply chain constraints, leaving critical building materials in short supply, driving up costs, and leading to significant construction delays. Sadly, in many instances, these challenges have forced numerous construction firms into insolvency, adding pressure on half-built projects, building insurance funds, and remaining construction companies.

At Acumentis, we’ve previously covered these issues in our ‘Last 30’ editions, highlighting the key drivers behind the industry's ongoing struggles.

We’ve all read about it, heard about it, or know someone who has experienced it. But where is the industry at now? As we kick off into the 2024/25 financial year, we’ve collated the latest expert knowledge from our valuers on the ground across Australia to explore whether the construction industry is still in crisis or has settled into a more stable cost environment.

The Current Landscape – A Mixed Bag

The results are mixed, and with a country as large as ours and with different sub-economies, it’s little wonder.

Eastern States

Across the eastern states of Queensland, New South Wales and Victoria, construction costs are reportedly easing, partially due to the decline in dwelling approvals and an increased availability of trades (in some but not all locations). Despite this, costs for owners are still high, with no sign of decreasing any time soon. According to Rawlinsons Australian Construction Handbook, the rate per square metre for a new build project home increased by 29% in Brisbane, 31% in Sydney, and 30% in Melbourne between 31 December 2019 and 31 December 2023. Aside from rising material costs and trade shortages, builders have incurred additional costs that need to be considered in their pricing. These are items which are unlikely to decrease in the short term, and include:

Insurances

Premiums for home building compensation cover, which protects homeowners if their builder cannot complete building work due to becoming insolvent, have increased due to the number of successful claims being paid out following the collapse of a disproportionately high volume of small and large construction firms. Other mandatory insurances, like public liability cover, have also increased.

Engineering

Putting the cost of materials and labour aside, an intensification of engineering in some areas has resulted in construction becoming more expensive, requiring additional or alternative materials and building methods. For example, increased building specifications in flood-affected areas have resulted from major flooding events.

State and Federal government housing initiatives (such as the Housing Australia Future Fund or ‘HAFF’) have also resulted in greater demand for construction in certain areas. This has removed many contractors and skilled labour from the housing market, exacerbating the shortage of skilled tradies in parts of the construction industry. These “Big Build” projects often offer higher union wages and better conditions.

Stabilising Factors

Despite these challenges, costs are starting to stabilise, and this is in part due to:

Dwelling Approvals

According to ABS data, the total number of dwellings approved in Australia in the 12 months to June 2024 fell by 3.7% from the previous year to 13,237 (seasonally adjusted). However, this is not consistent across the country, with NSW and Victoria reporting an 18.8% and 13.5% decrease from the previous month (respectively), yet Queensland reporting a 14.6% increase from the previous month.

Trade Availability

Whilst the issue of labour shortages for skilled tradespeople is still prevalent, in some regional areas, this has now transitioned into a saturated supply of trades and decreased demand from builders due to lower dwelling approvals.

Consumer Confidence

Following the recent surge in builder insolvencies, a crisis in consumer confidence has emerged, leaving many potential homeowners hesitant to proceed with new projects due to fears that their builder might collapse midway through construction. According to the Australian Securities & Investment Commission (ASIC) data reported by the Financial Review, over 2,800 construction industry insolvencies were recorded during the 2023-2024 financial year (Australia-wide), reflecting a 28% increase from the previous financial year. As a by-product, this lack of confidence has put further pressure on prices of existing stock, with recorded premiums being paid for ‘as new’ or renovated homes in lieu of taking on any construction risk.

Southern Australia & Tasmania

In South Australia and Tasmania, construction timeframes and availability of materials appear to be back to pre-COVID levels in some locations, and the industry looks to be stabilising somewhat. However, costs are still on the rise, which continue to be accepted by the market, and there still remains a degree of financial pressure on construction firms as insolvencies continue to occur. Rawlinsons indicate that Adelaide had one of the highest increases in costs since 2020, at 45% for a standard residential project home. The largest hike in costs occurred in the 12 months to 31 December 2023, increasing by 30% in just one year.

Western Australia

In Western Australia, build costs remain high, and there is a scarcity of builders and trades to quote and undertake work. This is likely due to the high demand for new supply due to extreme housing shortages, builder insolvencies, and widespread labour shortages.The latter is further exacerbated by builders losing trades from the residential construction industry to the mining industry, where wages are considerably higher. Thus, the cost of labour must further increase to compete. Perth experienced the highest increase in construction costs for a project home, at 53% since 2020. Similar to Adelaide, the majority of that increase occurred in the 12 months to 31 December 2023 at 36%.

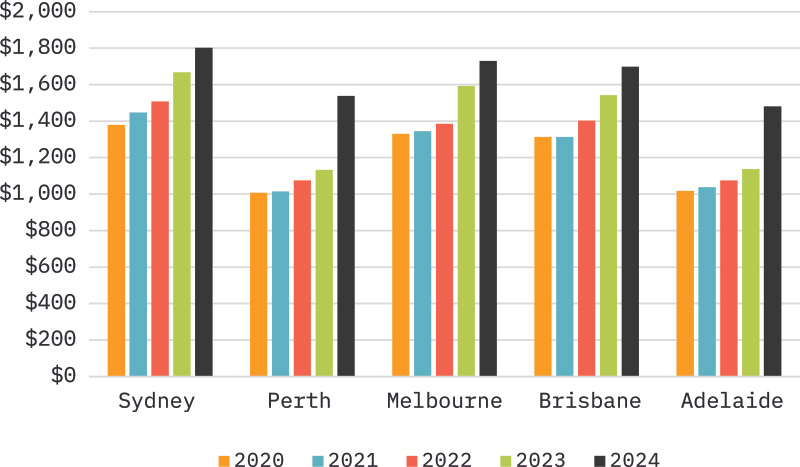

Below is a summary of the cost increases since 2020 for a new build project home, sourced from the Rawlinsons Australian Construction Handbook.

The construction landscape across Australia remains uncertain, with varying trends and challenges depending on the region. At Acumentis, we provide decision certainty in this unpredictable environment by offering:

- Independent Cost Checks: We provide informed, independent checks against building contract prices.

- Risk Alerts: We alert you to any risks, including fixed and non-fixed price contracts, overcapitalisation or inflated build costs, and progress drawdown schedules, which may be out of line with industry parameters or front-end loaded.

- Progress Inspections: Our regular, thorough progress inspections ensure the payments align with the physical progress on site.