The Australian Industrial property sector remained generally buoyant during 2020, outperforming other commercial sectors such as retail and CBD offices which were impacted by the COVID-19 pandemic. The industrial market remained somewhat insulated from the effects of the pandemic due to the ongoing demand for distribution and logistics, cold storage and manufacturing. In recent years there has also been increased demand for industrial land for the construction of data centres.

The pandemic had the effect of disrupting some existing trends whilst accelerating others.

Increased online shopping due to COVID lockdowns and general consumer hesitancy to visit shops created greater demand for distribution and logistics space, generally accelerating the existing trend away from brick and mortar shops toward online shopping.

Disruptions to international supply chains and vulnerabilities exposed by the pandemic in relation to imported products including PPE and critical medical equipment such as ventilators has led to local manufacturers pivoting to meet the demand. Furthermore it has sparked some discussion as to whether more goods (particularly medical supplies) should be manufactured locally as a matter of national security, potentially reversing the previous trend of globalisation which had coincided with the decline of the Australian manufacturing sector. In addition, the ability for factory staff to work in a socially distanced manner generally allowed manufacturing and other industrial operations to continue in a way that other some commercial sectors could not.

The large number of office workers working from home, with this trend possibly to continue post-pandemic, has created greater need for the adoption of cloud computing by firms, theoretically stimulating further demand for data centres.

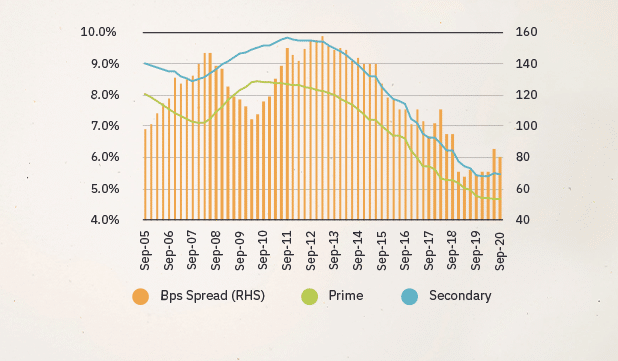

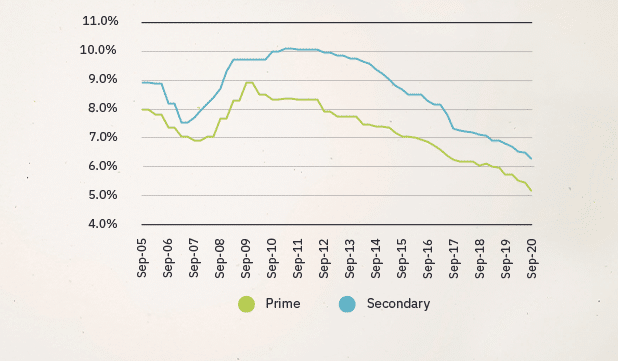

In general, 2020 saw the continued rise in capital values and compression of yields in the industrial sector, with the exception of Q2 2020 which saw the market briefly soften due to the initial public anxiety relating to the start of the global pandemic. The 2nd half of 2020 saw the industrial market recover and strengthen as public confidence increased due to the generally positive handling of the pandemic by Australian Federal and State governments.

The outlook for 2021 remains positive for the industrial sector. To date Australia has sustained a generally successful COVID-19 suppression policy, whilst demand for distribution and logistics, cold storage, manufacturing, and industrial land is expected to remain buoyant. It is anticipated that a successful Australian rollout of COVID-19 vaccines in 2021 will lead to improved consumer confidence.