The self-storage market in Regional Queensland and Australia has experienced growth over the last 3 years, leading to firming yields and increased rates per square meter for storage units.

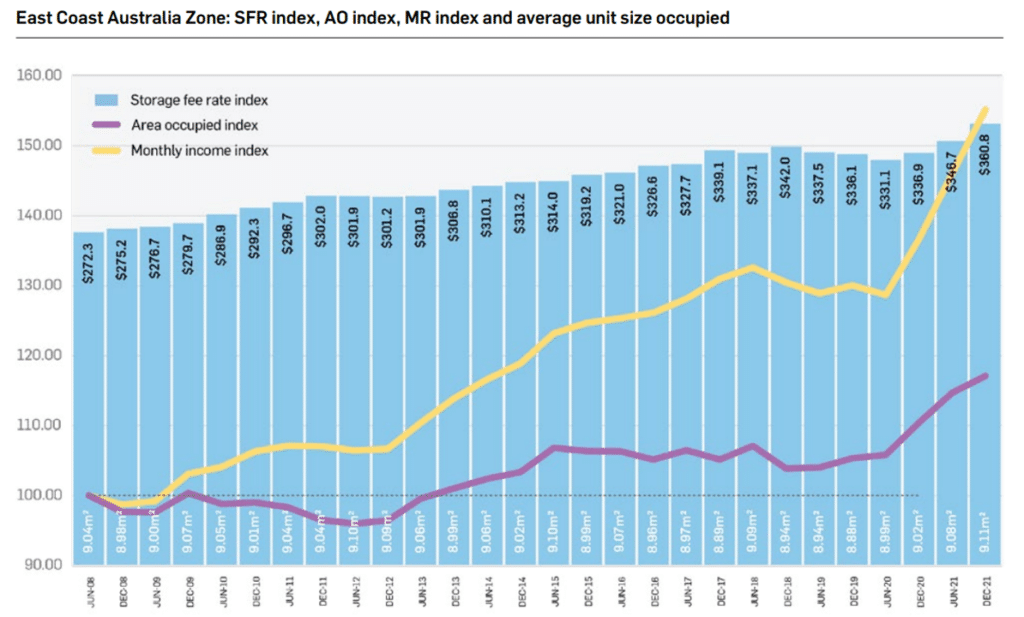

One of the key factors driving high occupancy is the remarkably low rental vacancy rate, coupled with the growth in the residential rental market. Due to the shortage of housing, individuals often need to rent smaller dwellings or units, resulting in a heightened demand for secondary storage. The Urbis Self Storage Index report for December 2021 (released March 2022) shows the weighted average rate per square metre for self-storage across the East coast of Australia. The graph demonstrates the steady growth in achievable rentals for storage units from June 2008 to December 2021, peaking in December.

Occupancy rates in major regional centres in Queensland continue to show strength. Evidence suggests that many complexes in these areas maintain occupancy rates of 90% or higher, with reports of some reaching 100% occupancy and having ongoing waitlists. The Urbis Self Storage Index report for December 2021 (released March 2022) further supports this, revealing that occupancy rates throughout Australia remain above 87.48%, with Brisbane Outer reporting 94.41% occupancy. The table below breaks down the data from the report:

Self-Storage Occupancy Rates

| Zone | Occupancy by Area |

| Sydney Inner | 92.39% |

| Sydney Outer | 90.12% |

| Sydney | 91.29% |

| Melbourne Inner | 93.67% |

| Melbourne Outer | 91.45% |

| Melbourne | 92.30% |

| Brisbane Inner | 92.27% |

| Brisbane Outer | 94.41% |

| Brisbane | 93.24% |

| Perth | 87.48% |

| Adelaide | 90.89% |

| Auckland | 93.29% |

| East Coast Australia | 92.04% |

| Australia & New Zealand | 91.53% |

Investing in self-storage offers owners the potential for diverse income streams, as occupiers range from individuals to organisations. Facilities often offer a variety of unit sizes, appealing to a wide market segment. This differs from other commercial property types in regional centres, which typically rely heavily on a single or a handful of tenants.

As with any asset, effective management is key and throughout regional areas differing styles of management are often seen. Smaller complexes are generally managed through local real estate agencies as part of their rental roll. Additionally, with the progressing of technology, mobile phone-based applications have emerged that streamline shed management with limited face-to-face interaction. These apps handle rental applications, weekly or monthly rental payments and provide access codes for entry into the complex. If an occupier fails to pay rent or falls into arrears, these apps can restrict access to the facility. Such applications enable owners to manage their complexes with limited day-to-day involvement.

To give an indication of the returns that we have seen in complexes throughout Regional Queensland, we have included a table showing recent sales, detailing yields and rates per square meter for sheds:

Sales Data for Regional Queensland Self Storage

| Location | Sale Price |

Sale Date |

Equivalent Yield |

$/Unit |

| Dalby | $520,000 | Mar-21 | 6.38% | $7,536 |

| Bundaberg East | $495,000 | Feb-21 | 7.47% | $20,625 |

| Thabeban | $1,645,000 | Mar-21 | 7.36% | $14,304 |

| Yeppoon | $450,000 | Jan-22 | 4.59% | $28,125 |

| Emerald | $900,000 | Feb-23 | 8.71% | $17,308 |

| Townsville | $370,000 | Dec-20 | 10.60% | 19,473 |

The sample of sales provided above show a diverse range of yields ranging from 4.59% up to 10.60% with $/m2 rates of units ranging from $7,536 up to $28,125. We note these sales are for smaller scale storage complexes and all complexes except for Dalby had occupancy levels upwards of 90%. The Dalby complex had potential upside, and this was reflective in the yield and low occupancy.

Error: Unable to load Block variation: showperson