The Australian Property Institute (API), the national governing body for property valuers, has released a commissioned report, offering long-term financial performance data of the various sectors within the property industry.

The results contained within the report provided some interesting findings.

Agriculture was a standout performer across the last two decades, showing a 256% return, compared to other sectors that achieved returns of around 150%: Industrial (164%), Residential (154%), and Commercial (143%).

CAPITAL CITY HOUSE PRICE INCREASE 2005-2024

| RANK | AREA | % INCREASE |

| 1 | Adelaide | 175 |

| 2 | Hobart | 172 |

| 3 | Sydney | 171 |

| 4 | Brisbane | 169 |

| 5 | Melbourne | 169 |

| AVERAGE | 154 | |

| 6 | Canberra | 148 |

| 7 | Perth | 123 |

| 8 | Darwin | 102 |

| INFLATION | 67 |

Fig 1 – Capital City House Price Increases 2005-2024. Source Australian Property Institute Source: ABS Suburbtrends. Average including Darwin and is on a non-weighted population basis.

CAPITAL CITIES UNIT PRICE 2005-2024

| RANK | AREA | % INCREASE |

| 1 | Hobart | 133 |

| 2 | Adelaide | 129 |

| 3 | Melbourne | 109 |

| AVERAGE | 106 | |

| 4 | Brisbane | 105 |

| 5 | Sydney | 98 |

| 6 | Perth | 96 |

| 7 | Canberra | 89 |

| 8 | Darwin | 88 |

| INFLATION | 67 |

Fig 1 – Fig 2 – Capital City unit Price Increases 2005-2024. Source Australian Property Institute Source: ABS Suburbtrends. Average including Darwin and is on a non-weighted population basis.

As seen in the figures above, housing and unit growth in both Adelaide and Hobart outperformed the larger capital cities like Sydney and Melbourne.

One factor helping to drive national growth has been interest rates over this time frame. The late 1980’s saw the cash rate at 17%, in recent years the rate has reached as low as 0.1%. With lower interest rates, the ability to borrow larger amounts has been made available, there have been a vast number of private lenders entering this space, offering consumers freedom of choice. Over this time also the dynamic of borrowers has shifted. In 2025, the majority of loans are being taken out by dual income households which has also increased the borrowing capacity, having an impact on dwelling prices over time.

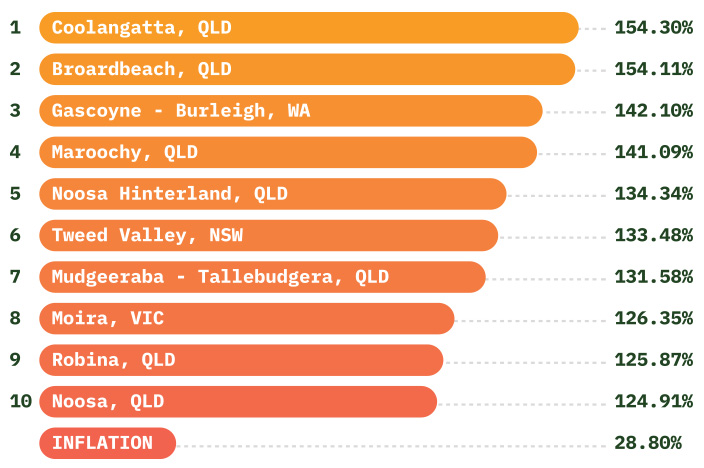

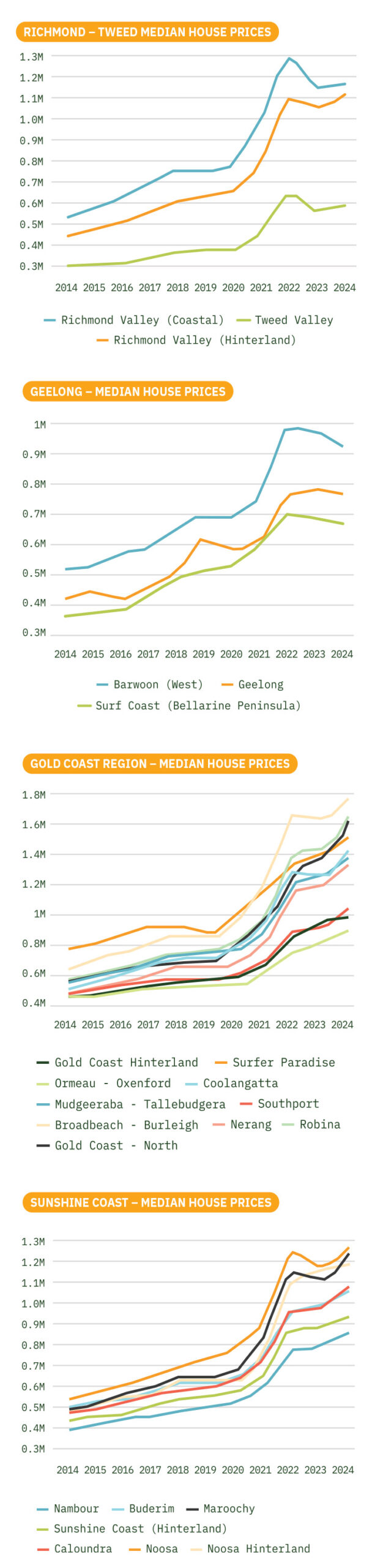

Not only have the major capitals obtained an uplift in prices over the past two decades, infrastructure investment and immigration policy has helped to promote the regions as an affordable option for home buyers. More recent history, thanks to the COVID pandemic, saw a real boom for some of our regions as the ‘tree change’ phenomenon became a reality for many. Regional centres well serviced with good facilities and within reasonable proximity to major metro centres were best placed for an increase at this time. The API report reveals the following 10 regional towns to have had the highest increase in value over the past 20 years.

TOP 10 INCREASES IN ANNUAL AVERAGE MEDIAN HOUSE PRICES OVER 10 YEARS

Coastal areas within close proximity to major centres, proximity to airports and quality schooling and medical facilities featured highly on this list. Despite the significant gains seen throughout the pandemic, some of these regional hot spots have seen a correction in values. Interstate migration has slowed and pressure from employers for workers to return to the office has caused the correction.

With the increase in house prices over time, affordability has been a hot topic throughout the decades. The report reveals that only approximately 10% of the housing market was deemed to be in an affordable category for a household on the median income (requiring less than 30% of household income to service a loan). Eliza Owen, Cotality’s Head of Research revealed that there is still a significant gap between the median house price at $815,000 (nationally) with the value of property that a median income for household could afford sitting well below at $593,000.

Over the past two decades, housing has provided consumers with a solid return on investment, beating out other investments such as gold and shares in many locations. Whilst affordability still remains a concern for governments trying to balance the equation, it is clear that the concept of the Australian Dream being a marker for success still continues to be true.

With offices across metro and regional locations throughout Australia and with experts in every sector of property in Australia, Acumentis are well placed to assist you with your property decision making process. Whether buying or selling the family home or looking to invest, we can provide you with trusted advice on property matters.