In February, we published an article titled ‘Reading the Tea Leaves’, offering insights into the economic outlook for 2023. As we approach the year end, it’s time to re-visit those predictions to see what came to pass and where the economy is placed looking forward.

Housing Prices

Predicted to ease over 2023, in February we were seeing falls in property prices, particularly along the East Coast. Surprisingly, the predicted further easing to market conditions has not eventuated with an increase in property prices in many locations.

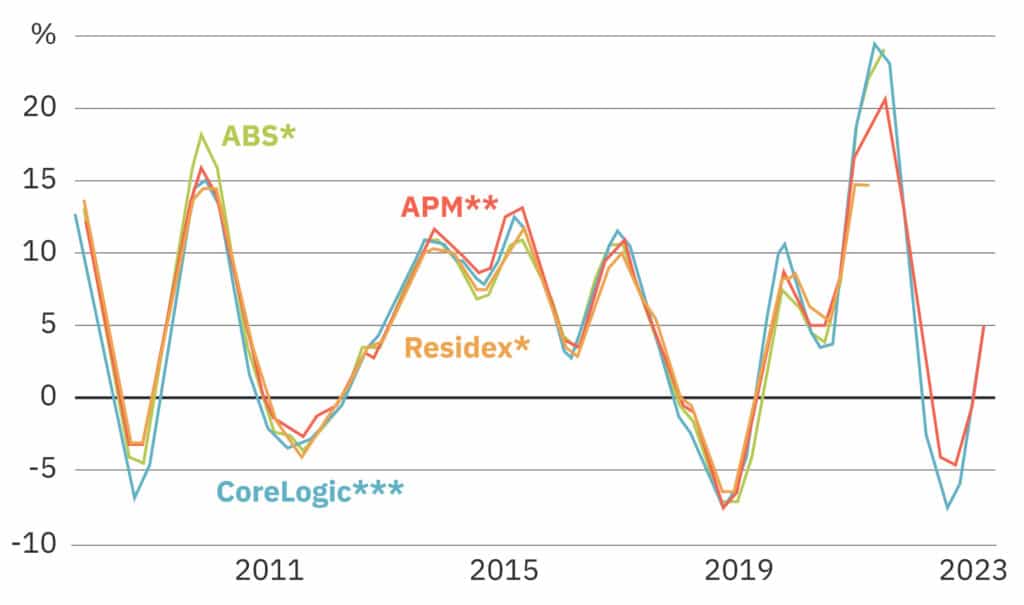

This graph on Housing Prices from the Reserve Bank of Australia shows an uptick over the year, although not reaching the peak levels seen in late 2021/early 2022. This trend has been a welcome relief to many homeowners but possesses challenges for anyone trying to enter the market.

Interest Rates: Beyond Expectations

The ‘Tea Leaves’ indicated further interest rate rises from the RBA in 2023. In February the cash rate was 3.35%, many economists were predicting the cash rate to peak at 4.2% with some predicting that at a cash rate of 4.2% a recession was inevitable. At the time of writing, the RBA cash rate is sitting at 4.35%, exceeding expectations.

Experts anticipated a ‘mortgage cliff’ as record low fixed rates rolled off to eye-watering fixed rates starting with a 6. To a degree, this ‘prediction’ eventuated, yet refinancing has been less than expected. With the increase in interest rates, serviceability has become an issue. Many homeowners are choosing to ride out the storm, utilising the savings buffer built during the pandemic to help with the substantial increase in loan repayments. Looking into 2024, it will be interesting to see how long households can continue to tolerate the ‘stormy’ conditions.

Recession

Initial predictions in February hinted at a 25% to 40% chance of Australia entering a recession by the end of 2023. While this chance failed to eventuate, it will likely feature in the conversation flowing into 2024. Part two of ‘Reading the Tea Leaves’, emphasises the importance of monitoring the level of unemployment, a critical factor influencing economic dynamics in 2024.

Supply Concerns

Supply was the issue in the early part of 2023 and continues to influence both market and economic conditions. While construction industry supply challenges have eased and become easier to manage, there is still a shortage of skilled workers, hampering the construction industry and keeping building costs high.

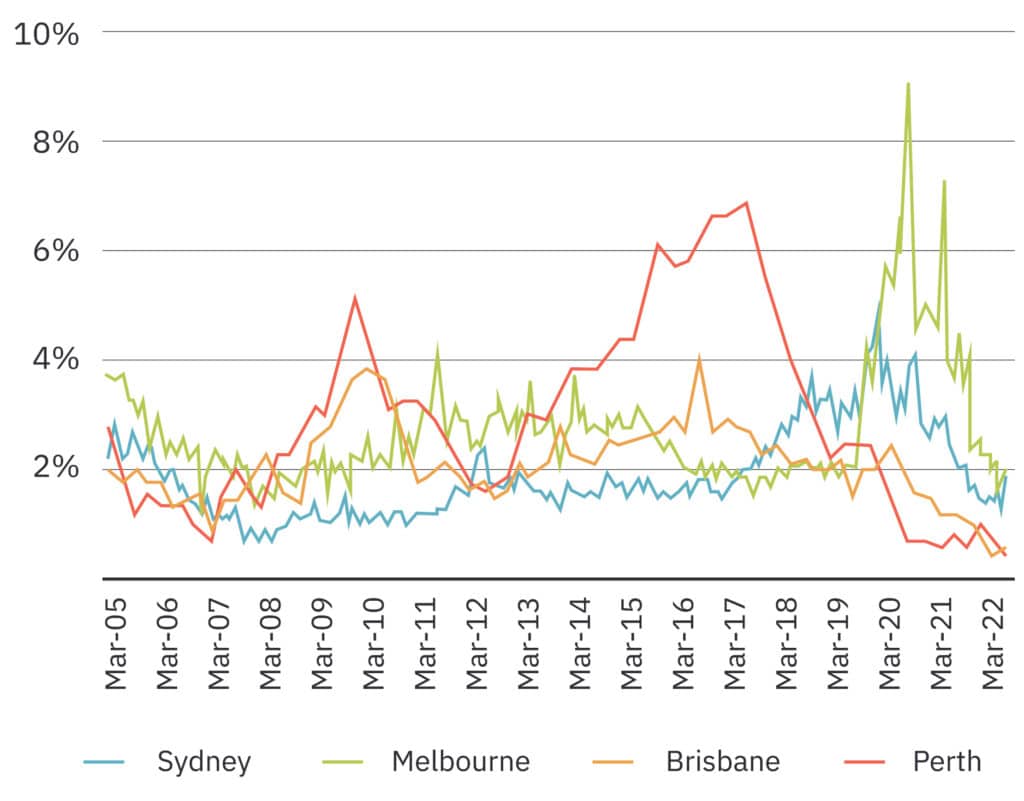

Unsurprisingly, households have been feeling the pinch during 2023 with not only interest rate rises but cost of living pressures. Fuel and electricity prices have seen significant increases over the year and the other major household cost that has continued to rise is rent. In most locations across the country the vacancy rate has plummeted. Immigration has substantially increased over 2023, putting further pressure on an already tight rental market.

Brewing Economic Challenges: Tea Leaves Take Time

As mentioned in February of this year, tea leaves take time to brew. Waiting and watching is key to reading the market. Looking back to what has occurred throughout 2023, there has been a lot of small and incremental changes by the RBA to carefully manage the economy and avoid a recession thus far. Further watching and waiting is required in the new year to see what is to come with inflationary costs, unemployment, and mortgage stress.

One thing we can predict is that 2024 will not be without its fair share of challenges.