Data current at time of publication - September 2023.

Units in the Perth CBD are often slow to respond to market upswings and quick to respond to market downswings and has traditionally underperformed in the unit asset class when compared to the Eastern States. The following article is going to explore some of the demographics and characteristics of our inner city, the reasons behind the more sensitive unit market and what we are seeing on the ground.

Demographics and characteristics of the CBD

Our inner city is relatively small when compared to the likes of Sydney and Melbourne. Perth, traditionally, has always had 'space' and thus, we have always had room for larger houses on larger blocks of land with a landscape backyard for our pets and kids to play.

As such, our inner city units are typically regarded as secondary assets in which people turn to when the house and land options are not available.

As a result, we see our inner city being predominately rental assets, with REIWA reporting approximately 63.2% of dwellings in the city are rentals.

- The demographics in the city is highly characterised by:

- A larger international population (with a culture more accepting of higher density living)

- Students

- Young professionals

Why is our unity market more sensitive than our housing market?

From the time interest rates began to increase back in 2022, we saw an almost immediate halt on the price growth of units in the CBD. Below are the major contributing factors:

- Preference within our city for larger houses on land

- Low and affordable median house prices

- High average salaries across WA which can absorb these house prices

- Dated stock in the CBD with limited new stock coming to market

What are we seeing on the ground?

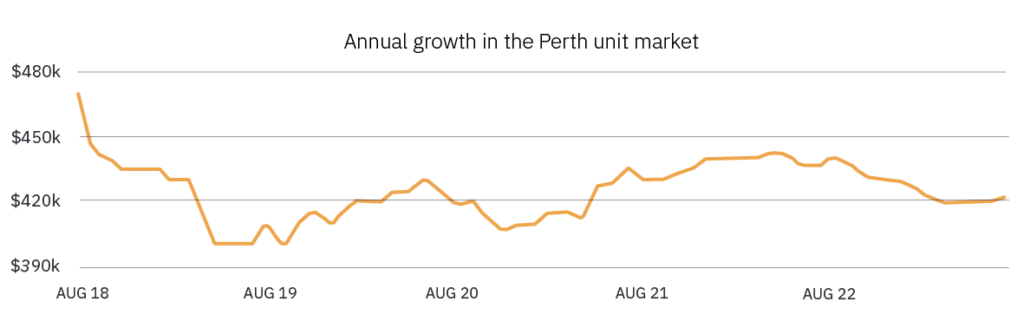

While the rest of Perth is largely experiencing positive growth on the back of crippling supply and steady demand, Realestate.com has reported a 3.4% decline in annual growth in the unit market in the Perth CBD.

Source: Realestate.com

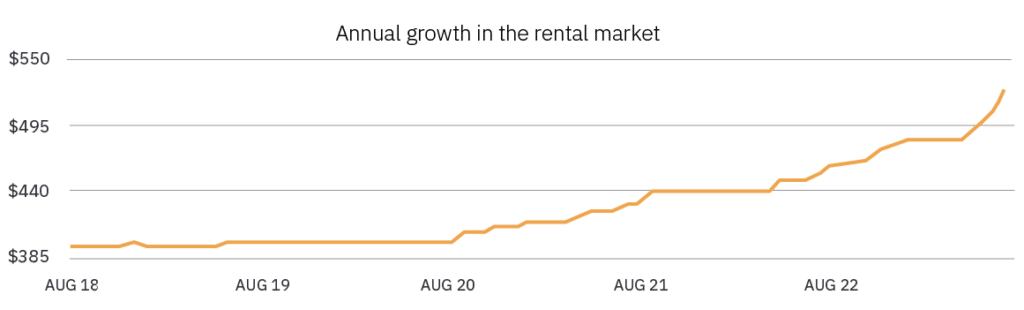

In contrast, the rental market for the inner city continues to rise.

Source: Realestate.com

On the back of this, the following demand is experienced in the inner city:

Investors

An influx of over east investors is tapping into the relatively cheap prices and the high yields achievable (often between 6% – 7% or higher). Investors are often sophisticated buyers without emotional attachment to assets and being from eastern states, are more comfortable with strata assets, unlike many local Perth buyers.

Owner Occupiers being outpriced in the rental market

While this is to a lesser extent in Perth currently, we are beginning to see our rental market become so expensive, some buyers are choosing to purchase affordable inner city products as a solution to renting.

In summary, the unit market in the Perth CBD is sensitive as a result of being a secondary asset. To shift local purchasers towards buying unit assets and improving the CBD market will require being outpriced in the more attractive house and land market. And as discussed, with Perth median prices remaining relatively cheap in comparison to our median salaries, the CBD may still have a long road ahead.