The increasing cost of living has extended into almost every corner of household expenditure, with insurance premiums becoming a growing concern for Australians. Acumentis’ recent discussion with Phil Hughes from Adapt Risk Solutions, highlighting the challenges and considerations of insuring strata buildings, sparked further discussion on the broader issue of escalating insurance costs across Australia.

Surging Premiums

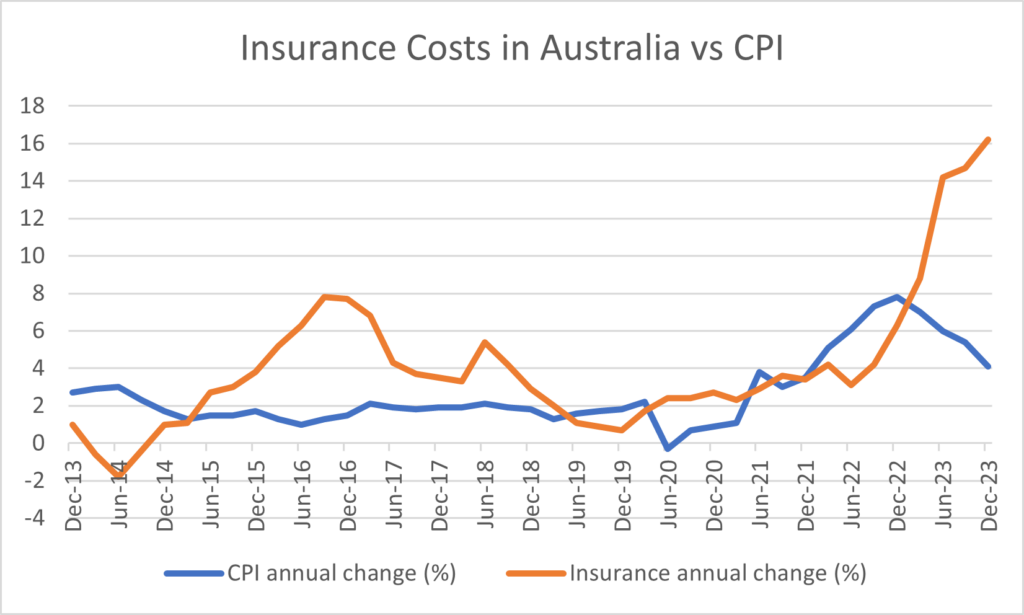

Data from the Australian Bureau of Statistics shows the percentage change in premiums compared to changes in the Consumer Price Index, and the resulting graph demonstrates the extent of the issue.

From mid-2022, insurance costs have steadily increased to the highest level in a decade. According to a recent study by the Actuaries Institute in August 2024, 15% of Australians were in a position of household insurance premium affordability stress by March 2024, up from 12% the previous year.

Affordability stress, as defined by the Actuaries Institute, as being equivalent to 4 weeks' gross weekly income. When you consider that this only accounts for household insurance and does not consider life insurance, car insurance, or health insurance, you can see why the average Australian household is taking a serious look at how they can reduce their expenditure.

Factors Contributing to Rising Premiums

There are a number of factors contributing to the rise in insurance premiums over the last 12 months.

- Increased Natural Disasters: The Insurance Council of Australia references the higher number of natural disasters—such as floods, bushfires, and cyclones—over recent years, leading to more claims. The ongoing risk of climate-related disasters is compounded by population growth, with more developments being constructed “in harm's way "—areas prone to such risks.

- Building Costs and Skilled Trades Shortage: Whilst the cost and supply of many building materials has eased, a shortage of skilled tradespeople has kept construction costs high.

- Rental Price Increases: Many home insurance policies also cover temporary accommodation if a property is destroyed or damaged. The cost of temporary rental accommodation has also significantly increased over this time frame.

- Reinsurance Costs: Insurers themselves are also facing rising costs for reinsurance, the global insurance purchased to protect against large-scale claims, which impacts the price of local premiums.

- Updated Risk Mapping: Post-disaster updates to flood and bushfire maps from local councils have led to more properties placed within those zones and classified as high-risk. There have been several recent articles in the press in relation to this, where homeowners have had increased premiums or have been unable to obtain cover for those specific risks. The report conducted by the Actuaries Institute indicates that exposure to flood risk is the most significant driver of insurance coverage and affordability.

Addressing Affordability and Risk

Homeowners may feel tempted to reduce their coverage to alleviate financial pressure. Some may opt to exclude certain types of coverage—such as flood insurance—or not renew their policies at all. However, homeowners must consider their mortgage obligations before making these decisions. Many mortgage contracts require insurance coverage, and reducing or cancelling policies may place them in breach of these agreements.

To help alleviate costs, some insurers and mortgage lenders are offering discounts to customers who have taken resilience measures to safeguard their homes. The Resilient Building Council offers tools that are being accepted by a small number of insurers and lenders as proof of a property owner's measures towards reducing their risk, which is being rewarded through interest rates and premium discounts.

The Risk of Underinsurance

The risk of an insurance shortfall is high when property owners make these decisions without full consideration of their current situation. When reviewing the insurance on your property, it is helpful to have an accurate assessment of the current cost of replacement for the improvements on your property. Acumentis has a team of valuers able to provide you with costings so that your decision-making is informed and accurate.