As a professional Perth-based Buyer’s Agent for Acumentis, I recently had the opportunity to attend the REBAA (Real Estate Buyers Agents Association) Conference in Sydney.

The conference was an enlightening experience, highlighting the varying market conditions across Australia and underscoring the importance of obtaining independent Buyer’s Agent advice when purchasing property.

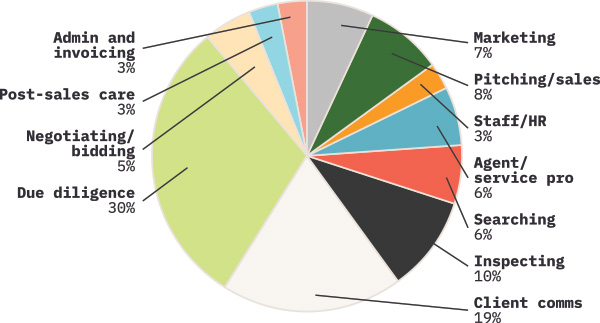

Many potential purchasers expect a Buyer’s Agent or property professional to identify a property to buy. However, the major part of the process involves determining what is a good buy. This requires a deep understanding of the property being considered and undertaking thorough Due Diligence (DD).

Where does DD Start?

Awareness of What Can Go Wrong

Understanding potential pitfalls is crucial in due diligence. Buyers need to be aware of issues such as undisclosed property defects, legal disputes over property boundaries, zoning restrictions, and environmental hazards. These problems can lead to unexpected costs and complications. By identifying these risks early, buyers can make informed decisions, negotiate better terms, or even walk away from a deal that poses too many uncertainties.

Knowing the Correct Documents in Each State and Territory

Each state and territory in Australia has specific documentation requirements for property transactions. These can include contracts of sale, vendor statements (such as Section 32 in Victoria), title searches, and building inspection reports. Familiarity with these documents ensures compliance with local laws and helps uncover any legal or financial issues tied to the property. A buyer’s agent must stay updated on these requirements to guide their clients effectively.

Preparing Your Client for a Realistic Outcome

Setting realistic expectations is a key part of the buyer process and forms part of the due diligence. Clients should be informed about the current market conditions, potential challenges in the buying process, and the property's true condition. This involves transparent communication about what can be achieved within their budget and timeframe. Agents can help clients make more grounded and confident decisions by preparing clients for possible outcomes.

Resist the Role of Miracle Worker

It’s important for Buyer’s Agents to manage expectations and avoid promising unrealistic results. While agents can provide valuable insights and negotiate favourable terms, they cannot guarantee perfect outcomes or eliminate all risks. Emphasising a realistic approach helps build trust and ensures clients understand the complexities involved in property transactions.

Your Pitch Should Focus on Risk Mitigation, Not Just Savings

When pitching services, focus on the potential issues you can help clients avoid rather than just the financial savings. Highlighting your ability to identify and mitigate risks, navigate legal complexities, and ensure a smooth transaction process can be more compelling. This approach underscores the value of your expertise and the peace of mind you provide.

Do Not Work with Unrealistic Client Briefs

Working with clients who have unrealistic expectations can lead to frustration and unsuccessful outcomes for all parties involved. It’s essential to assess client briefs critically and ensure they align with market realities. If a client’s demands are unattainable, it’s better to have an honest conversation and adjust their expectations or decide not to take on the brief. This ensures that your efforts are focused on achievable goals and productive relationships.

The Hard Truths of Property Investing

Capital Growth Cannot Be Predicted with Accuracy

Predicting capital growth with precision is inherently challenging due to the multitude of factors influencing property values. Economic conditions, interest rates, government policies, and local market dynamics all play a role. While historical data and market trends can provide some guidance, they are not foolproof indicators of future performance. Buyers should be cautious and avoid making decisions based solely on speculative growth projections.

Buffer Funds Are Essential

Having buffer funds is crucial when purchasing property. Unexpected expenses such as urgent repairs, increased interest rates, or periods of vacancy can strain finances. A financial cushion ensures that buyers can manage these unforeseen costs without jeopardising their investment. To maintain financial stability, it’s recommended to set aside a portion of the budget specifically for these contingencies.

Maintenance Issues Need to Be Accounted For

Maintenance is an ongoing responsibility that can significantly impact the overall cost of property ownership. Regular upkeep, repairs, and potential renovations should be factored into the budget from the outset. Ignoring maintenance can lead to more severe and costly problems down the line, affecting both the property’s value and amenities. Proactive management helps preserve the property’s condition and market value.

We Can’t Predict Market Fluctuations or Black Swan Events

Market fluctuations and black swan events—unpredictable and rare occurrences with significant impact—are beyond anyone’s control. Economic downturns, natural disasters, or global crises can drastically affect property markets. Buyers should be prepared for volatility and avoid making decisions based on the assumption of stable or continuously rising markets. Diversifying investments and maintaining flexibility can help mitigate risks.

Bad Tenants and Bad Neighbours Are Hard to Identify

Identifying problematic tenants or neighbours before purchasing a property can be difficult. Even with thorough screening processes, some issues may only become apparent after moving in or leasing the property. Bad tenants can cause damage, delay rent payments, or create legal issues, while troublesome neighbours can affect the property’s desirability and value. It’s important to have strategies in place for managing these situations, such as clear lease agreements and good property management practices.

Most Off-Market Sales Are Trouble and Do Not Always Show Value

While sometimes offering unique opportunities, off-market sales often come with hidden challenges. These properties might be off-market due to unresolved issues like legal disputes, structural problems, or overpricing. Without the competitive pressure of the open market, sellers may not be motivated to offer fair prices. Buyers should approach off-market deals cautiously, conducting thorough due diligence to ensure they get genuine value.

Set-and-Forget Properties Are Not Realistic, and You Need to Dedicate Time to Your Property

The concept of set-and-forget properties is largely unrealistic. All properties require ongoing attention, whether it’s for maintenance, tenant management, or responding to market changes. Active involvement ensures that the property remains in good condition and continues to meet investment goals. Buyers should be prepared to dedicate time and resources to manage their properties effectively.

Buyers Agents Can’t Guarantee Council Approval

Buyer’s agents can provide valuable insights and guidance on the likelihood of obtaining council approval for renovations or developments, but they cannot guarantee it. Council approval processes are subject to local regulations, zoning laws, and community considerations, which can be complex and unpredictable. Buyers should conduct their own research and consult with planning professionals to understand the feasibility of their plans.

Additional Considerations

Risks of Buying Properties Sight Unseen

One topic of discussion at the conference was the trend of interstate buyers purchasing properties sight unseen. While this approach can expedite the buying process, it carries significant risks. Photos and virtual tours can only reveal so much, and buyers may miss crucial details that could impact their investment. Buyers are encouraged to engage independent Property Buyer Agent Professionals to mitigate these risks. These experts act in the buyer's best interests, providing valuable insights and advice.

Maximising Returns through Property Tax Depreciation

The conference also highlighted the importance of considering property tax depreciations to ensure that you are maximising your returns. Understanding and effectively managing property tax depreciation can significantly enhance the profitability of your investment. At Acumentis, when buying a real estate asset, we highly recommend you get a Depreciation report when your property has been purchased. This will maximise your tax benefits and return tax dollars to you over the life of your asset. We urge all property buyers and real estate owners to contact our advisory team to enquire about our very cost-effective Depreciation reports that can save you thousands.

At Acumentis, our professionals offer expertise across all property sectors, providing the most accurate and beneficial advice tailored to your needs before, during and after the transaction. The right advice is crucial in property investment—not just for mitigating risks but for maximising your investment. Whether you're an experienced investor or a first-time buyer, seeking independent, professional advice is essential.