Are the stars aligning for a resurgence in agricultural property values?

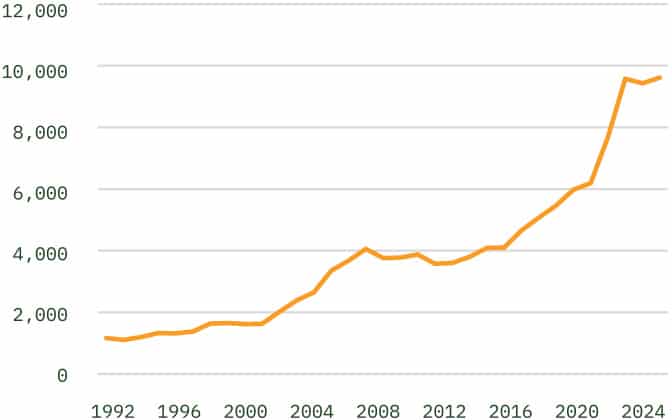

Following several years of strong value growth, the agricultural property market has experienced a noticeable softening. Over the past three years, rising interest rates, higher input costs, inconsistent seasonal conditions, and weaker commodity prices across many sectors have contributed to softer market conditions and dampened buyer demand in most locations. As a result, properties are requiring longer selling periods than previously, and values have generally plateaued, or in some cases, declined —aside from a few exceptions.

National Farmland prices, 1992 - 2024

Reasons for Renewed Optimism

A number of recent events suggest that there is the potential for an improvement in the purchasing power of agricultural investors.

- Interest Rates Stabilising: Interest rates appear to have peaked, with two recent reductions in the official cash price of 25 basis points each. Most economists are forecasting multiple further reductions in the latter half of 2025.

- Input Costs in Decline: Costs for key agricultural inputs, such as fertiliser and diesel, have declined materially from the peak prices of 2022.

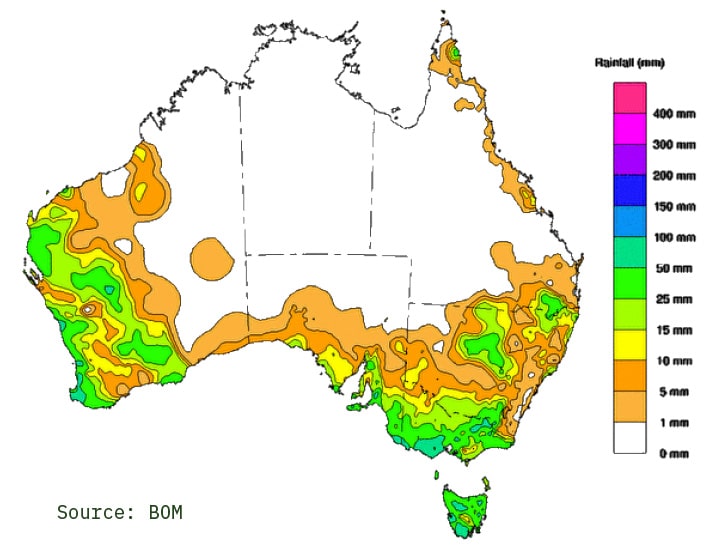

- Seasonal Rainfall: Recent rainfall events through southern Australia are likely to have rejuvenated confidence in the potential for a decent growing season in areas that have been struggling with drought conditions for consecutive years.

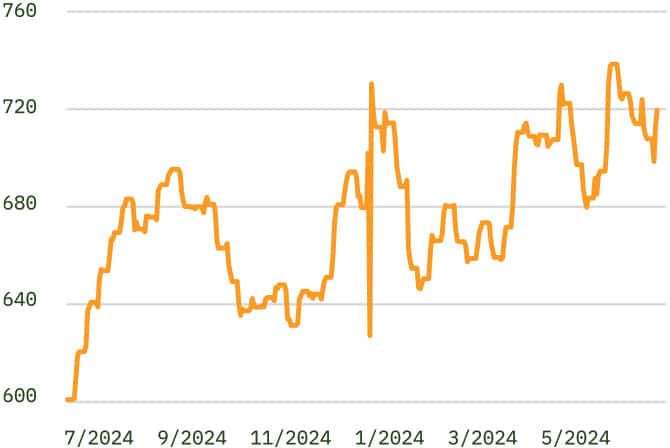

- Commodity Prices Strengthen: There has been a significant uptick in some commodity prices, which, combined with the increasing AUD since January, is improving the financial position of many primary producers (despite the US tariff situation). Notably, beef and lamb prices have experienced significant upward movement.

Cattle Indicator

Lamb Indicator

As shown in the above charts, prices have increased in the order of some 24% for beef and 37% for lamb over the last 12 months. The National Trade Lamb Indicator (NTLI) is at its highest price level in history, being some 125% higher than its recent low ebb in September 2023. The Eastern Young Cattle Indicator (EYCI) is still a long way off its peak of January 2022, but is some 103% higher than its October 2023 low point.

These price increases are partially a result of increased US demand for Australian beef and lamb, noting that US cattle numbers are at a historic low point. Australian beef exports have risen by over 30% YTD, despite the recent increase in US tariffs.

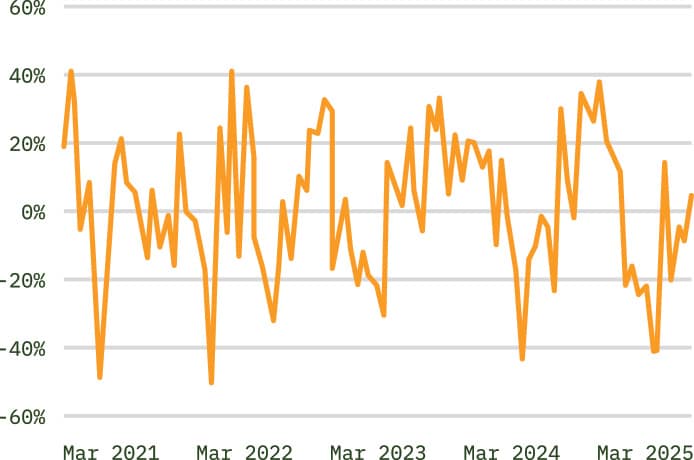

Rural Confidence Builds

Is this combination of factors likely to result in a rebound in the agricultural property market? Only time will tell, but current indicators are positive. This optimism is supported by the results of Rabobank’s latest Rural Confidence Survey (March 2025), which found that around 75% of surveyed farmers expect economic conditions to improve or remain stable. Perhaps even more telling, 90% plan to maintain or increase their on-farm investment over the coming year. All of which suggests that demand levels are likely to increase in the near future, potentially driving an increase in transaction activity.

Rabobank Rural Confidence Index

Source: Rabobank

With improving financial conditions, stronger commodity markets, and a more favourable lending environment, agricultural investors may soon find them selves with renewed appetite and capacity for property acquisition.

Source 1 | Source 2 | Source 3 | Source 4 | Source 5 | Source 6 | Source 7