Recent data shows modest lift amidst challenges – a glimmer of optimism…

In the last two years, we have closely monitored and reported on the nation’s spiralling construction sector, highlighting the many challenges faced by both the building industry and consumers alike. The far-reaching consequences of these challenges persist, affecting livelihoods across the industry.

Cost Fluctuations & Material Pressures

Recent data offers a glimmer of optimism, as certain building materials witness a welcome decrease in costs compared to earlier price escalations. This softening provides only a slight reprieve in easing cost pressures.

Notable reductions in the prices of all-important building materials like steel products and structural timber have been met with relief. However, inflation continues to drive up prices for various other building materials, maintaining a volatile environment for construction expenses.

Master Builders Australia reports that costs for concrete, cement, and sand products have escalated to now be 16.2 per cent higher than a year ago. These material cost increases, coupled with industry wage pressure and a critical labour shortage have created a complex scenario. Although there’s been a notable influx of skilled labour through migration, sustaining this workforce influx requires addressing the affordable housing shortage– a ‘Catch 22’ situation!

Migration & Housing Demand

The past financial year net overseas migration was forecast at 400,000 new arrivals, with elevated levels expected in the years to come. This surge in migration results in ongoing demand for housing within Australia further adding to the pressure to construct new dwellings.

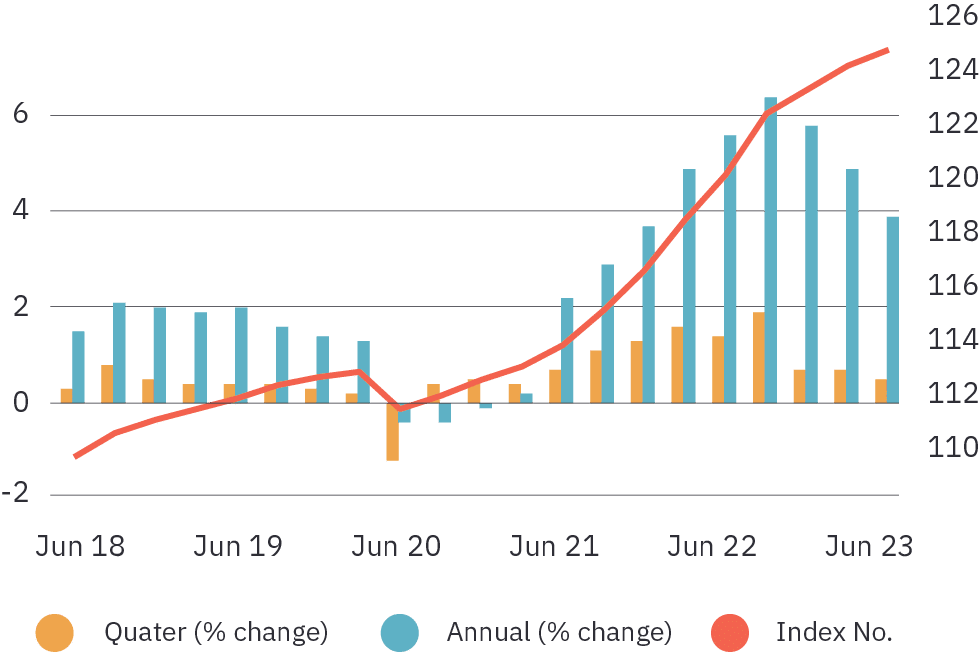

According to CoreLogic’s Cordell Construction Cost Index (CCCI), which tracks the cost to build a typical new residential home, we experienced a quarterly growth rate of 0.7 per cent for the June 2023 quarter. This is the lowest rate since September 2020 and notably less than the 1.2 per cent decade average, demonstrating a significant deceleration of growth.

Dwelling Approvals & Housing Shortage

A significant drop-off in dwelling approvals in the year to April 2023 has been recorded and this trend is expected to flow through to further aid price correction as the volume of residential construction work reduces in the short to medium term. The issue of low building approvals, combined with a growing population, continues to intensify the housing shortage.

Given the surge in Australian construction companies collapsing in record numbers and insolvency rates reaching their highest levels in a decade, several key factors are expected to plague the construction sector for some time yet, including:

- The fallout from 12 interest rate increases in 14 months, coupled with a significant reduction in consumer borrowing capacity.

- Inflation issues and pressure on Governments to create solutions.

- Construction companies struggling to manage cashflow and source capital.

- An elevated number of building projects no longer deemed financially viable, necessitating a higher volume of pre-sales.

- A lack of consumer confidence in undertaking a new build due to fear of losing their money.

- Uncertainty of further cost escalations for labour and materials, and blowout times of completion dates.

- Increased pressure on the established housing market, with off the plan projects suffering.

- Builders’ ability to deliver their obligations under fixed price construction contracts.

According to ABS, Prices in Final demand increased 0.5% this quarter, marking the lowest quarterly growth since March 2021. While price increases have largely moderated, the Construction industry continues to drive growth in Final demand. The main contributor of quarterly growth in Final demand was the output of building construction (+0.9%), due to ongoing skilled labour shortages and the passing through of manufacturing costs from energy intensive materials such as plaster, concrete, cement, sand and plumbing products.

Supply chains are improving and with the falling demand for new construction, this is allowing builders to work through their backlog of contracted work.

Increase in final demand eased this quarter to 0.5%

The critical challenge of housing supply and affordability has been a subject of heated debate for some time and the pressure on the Australian Federal Government has culminated in the recently announced proposed plan to build 1 million new homes in Australia by the end of the decade. This initiative would involve agreement and collaboration between the Federal Government, State Government, private investors and the construction sector to deliver the target of 1 million new homes by 2029.

While this proposal aims to alleviate the housing crisis by boosting supply and striving to accommodate demand, this will of course create significant pressure on the construction sector including the supply and pricing of materials as well as availability and cost of skilled labour. With an already stretched industry that is still facing challenges, this may put new pressures and cause volatility on construction prices.