A Guide for Family Lawyers Assisting Separating Clients

Navigating challenging discussions during property dispute resolutions or mediations can be a complex and emotionally charged aspect of family law.

As legal professionals, family lawyers play a crucial role in guiding clients through this process, including helping them understand the factors that influence property valuation figures.

A well-informed approach to property valuations lets lawyers explain the valuation process clearly to their clients, manage expectations and reduce unnecessary disputes.

This guide provides an overview of the critical elements determining a valuation figure, focusing on the key considerations valuers assess when selecting a property’s market value.

The Valuation Process: An Art & A Science

Property valuation is often described as both an art and a science. The science involves applying structured valuation methodologies, while the art comes from the valuer’s ability to interpret market trends and use professional judgment to specific properties.

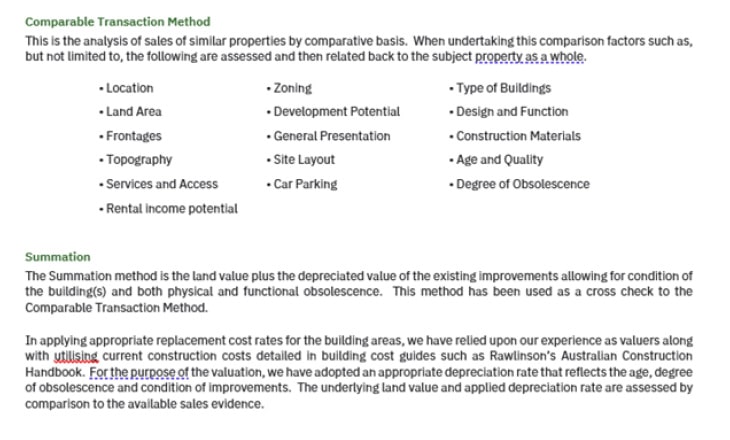

The International Valuation Standards (IVS) govern the valuation process, ensuring consistency and reliability. This exert you will have seen from our valuation reports is from the IVS detailing the various valuation methods that apply to the valuation of residential property.

These valuation methods are complex, with multiple factors influencing how a property is assessed and its final value.

To simplify the process to a level that is easily understandable and applies strictly to single-use residential property, we will concentrate on the Comparable Transaction Method. In this method, the value of a property is based on sales of comparable properties, and the different attributes between the subject property and the sale properties are monetarised.

5 Key Aspects Used in Property Valuation

When valuing a residential property for family law purposes using the comparative transaction method, a valuer considers the five critical elements below, which shape the final valuation figure.

1. Location

The saying “location, location, location” holds true in property valuation. The desirability of an area plays a significant role in determining a property's value.

- Better quality locations generally attract higher valuations and vice versa. To limit this variability, the valuer will use sales in the immediate or comparable areas if that evidence is available.

- Factors such as proximity to schools, public transport, amenities, and lifestyle offerings contribute to desirability.

- Valuers assess location differences at the street level, as even within the same suburb, property values can vary significantly—many suburbs have good streets and not so good.

2. Land Characteristics

The underlying land plays a vital role in determining property value. Factors considered include:

- Size and shape of the land parcel.

- Topography (flat versus sloping land).

- Views and aspects that can influence market appeal.

- Proximity to power lines, train lines, or industrial zones, which may negatively impact value.

3. Dwelling Attributes:

The structure itself is a major component of a property’s value. When valuing a home, especially in family law matters, an internal inspection is crucial. Key considerations include:

- Design and architectural style, age, quality and condition.

- Size and layout, functionality, including number of bedrooms, bathrooms, and living spaces, car accommodation, outdoor living.

- Build quality and condition, including materials used and workmanship.

- Defects or maintenance issues that could impact value.

4. Ancillary Improvements

Beyond the main dwelling, additional features and ground improvements contribute to overall market value and are considered in the valuation. The include;

- Swimming pools, spas, and tennis courts.

- Garages, carports, and sheds.

- Landscaping and outdoor entertainment areas.

5. Market Timing

Real Estate markets are a moving feast, and they rapidly change, influenced by economic conditions, interest rates, and supply-demand dynamics. Valuers will use up-to-date sales to reflect current market conditions. If older comparable sales need to be used, adjustments will be made to reflect market movements between the sale and the assessment date.

Why Experience Matters in Family Law Valuations

Family law property valuations require a high level of expertise. Unlike general property appraisals, they often involve legal scrutiny and can be contested in court.

For this reason, Family Law valuations should be conducted by experienced professionals—at Acumentis, only valuers with at least five years of experience perform these assessments. These experts:

- Apply the Comparable Sales Method with precision.

- Understand the monetary impact of property differences.

- Stay up-to-date with market fluctuations.

Importantly, valuation is not an exact science with a single, definitive number. Instead, it operates within a range of values, and the art of applying professional judgment plays a key role in determining the most accurate assessment.

For family lawyers, a solid understanding of property valuation ensures they can provide accurate guidance to their separating clients, manage expectations, and facilitate smoother dispute resolution. By recognising the factors that influence a valuation figure, lawyers can help clients approach property settlements with greater clarity and confidence.

If you need independent, court-compliant property valuations for family law matters, our team at Acumentis is here to assist.