It is interesting to note that, despite very low vacancy rates across Australia and record rent increases, investors are starting to bail out of the property market in greater numbers. This trend is likely to create even more pressure on the rental market, as these properties are often snapped up by owner occupiers.

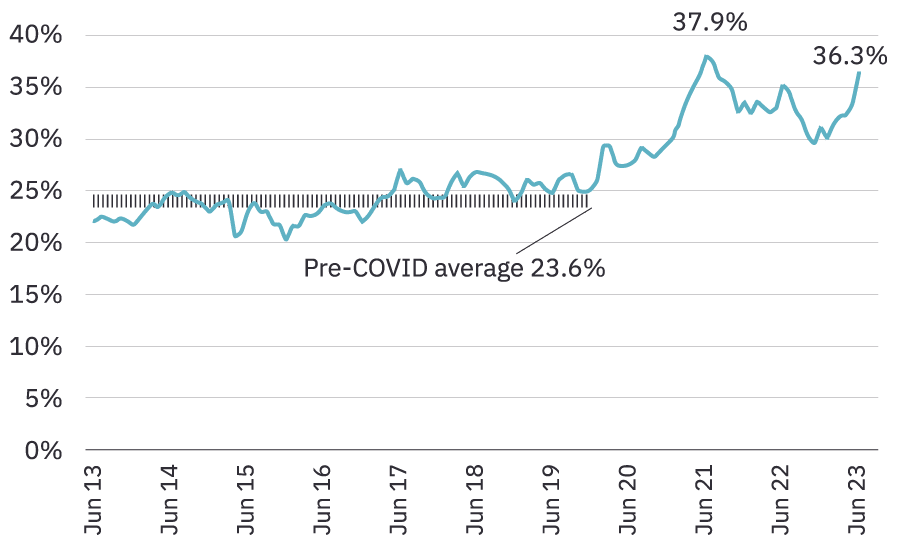

Recent research by CoreLogic Australia shows that 36.3% of listings are investor-owned, a substantially higher percentage than at any other time over the last 10 years, except when the market was going gang busters in the middle of the Covid pandemic.

Higher Interest Rates and Budget Constraints

The main driver behind this increase in listings is most likely the rise in interest rates, which is significantly impacting investor budgets. Investors generally pay higher interest rates than owner occupiers, and those highly geared investors will be in a world of pain with the record increase in interest rates over the last 12 months and beyond.

Increased Land Tax

Interest rates are not the only cost crunch affecting investors, they are also grappling with increased taxes on investment properties. Land tax has become an issue for investors, particularly in Victoria, where significant changes have recently been introduced, adding to the costs of holding investment properties.

In May, the Victorian State Government announced the introduction of a COVID Debt Levy as part of the state budget. One of its components is a lowering of the threshold for Victoria’s land tax from $300,000 to $50,000. This change is expected to affect about 380,000 homeowners with investment properties and holiday homes who were previously exempt from paying paid this tax.

Beside land tax adjustments, there are several other state-level policy and regulation changes that are making owning an investment property more onerous. These changes and the increasing number of investor sales are shaping the property market landscape and could have implications for both investors and renters in the coming months.