The International Valuation Standards Council (IVSC), based in London is the independent organisation which establishes and executes standards for the valuation of assets which are internationally accepted. Established in 1981, the IVSC comprises over 200 member organisations operating across 137 countries, including Australia.

At the heart of the IVSC are the International Valuation Standards (IVS), which apply to the valuation of various asset types including real estate, plant and equipment, intangible assets, securities and businesses.

These are adopted in full by the Australian Property Institute (API) and by Acumentis.

The IVS are updated by the IVSC every few years, and in January 2024, the IVSC announced and published a new set of standards, effective from 31 January 2025.

The structure of the IVS comprises 7 general standards and 8 asset standards. According to the IVS, “the General Standards apply to all assets and liabilities, they are the starting point for any valuation”, whereas “Asset Standards provide requirements in addition to the general standards for specific types of assets and liabilities”. Let’s take a look further into what’s new.

General Standards

The seven general standards which apply to all valuations are;

IVS 100 Valuation Framework

This covers general principles including ethics, competency, compliance and professional scepticism, and can be applicable from initial engagement between the Valuer/client through to post-delivery of the valuation service. Significant updates and a restructuring of IVS 100 were included in the 2025 edition of the IVS, including new sections relating to Valuer Principles, Valuation Process Quality Control, the use of Specialist or Service Organisations.

Valuation Process Quality Control

This is a newly expanded standard which mandates quality controls around the valuation process. The Valuation Process Quality Controls aim to ensure valuations are performed “objectively, transparently, without bias and in compliance with IVS”, with the process and periodic assessment of these controls being documented, and should assess the judgements made by the Valuer (eg “are they reasonable and free from bias”) in assessing the valuation figure.

In essence, this is a critical part of any valuation, ensuring there is a level of review and challenge in every assessment. This is not necessarily a new concept to the valuation industry.

IVS 100 also clarifies that adherence to both General Standards and Asset Standards is required for an IVS compliant valuation.

IVS 101 Scope of Work

This standard refreshes the minimum requirements for agreed scope of works between a client and the Valuer. It also introduces the concepts of Valuation Reviews, and sets a clear position that a Valuation Review is not a Valuation, meaning if the scope of works between parties includes a Valuation Review, this will not constitute undertaking a new valuation or opinion of an asset’s value.

The following defined terms are relevant to this section:

- A Valuation, being the process of undertaking a valuation;

- A Valuation Review, which can either be the review of a valuation process, or the review of a value conclusion, or both;

- Valuation Process Review, being the review of a valuation to assess compliance with IVS (does not include a review of the opinion of the assessed value); and

- Value Review, being a review of the valuation conclusion including various components such as comparable evidence, adopted valuation parameters (yield/capitalisation rate, rates per square metre/hectare etc), in order to provide an opinion on the valuation conclusion of another Valuer’s work. This may be completed by an internal, external or third-party reviewer.

IVS 102 – Bases of Value

IVS 102 is largely unchanged conceptually, but includes the following additions:

- Consideration of information that would not be known or knowable with reasonable due diligence on the valuation date, such as with retrospective or ‘backdated’ valuations, is prohibited.

- Additional bases of value (outside of the IVS defined list) may be required for certain valuation purposes such financial reporting, tax reporting or in other legal or regulatory context, and may include ‘Fair Value’ in line with International Accounting Standards (such as for business valuations).

- A mandate that where special assumptions are used as part of a valuation conclusion which greatly impact the assessed value (such as hypothetical or alternative scenarios), the assumption must be reasonable, supported by evidence and must be relevant having regard to the intended use of the valuation.

IVS 103 – Valuation Approaches

This is an existing but revised chapter (no re-inventing of the wheel here). The three principle valuation approaches (unchanged) are:

- Market Approach,

- Income Approach, and

- Cost Approach

IVS 104 – Data and Inputs

This is an entirely new section, although guidance on this topic did exist in previous iterations of IVS. This section addresses the importance of data quality and exercising Valuer judgement, and defines the characteristics of relevant and observable (‘good’) data. These are: accuracy, completeness, timeliness and transparency. Valuers will often use data provided or obtained from other sources, for example, from our clients, from the property or business owner, selling/leasing agent, as well as from Government and proprietary data sources. IVS 104 requires Valuers to determine that the data is fit for use and that it meets a balance of the above characteristics, noting that not all data will “tick every box”. However, there is greater emphasis on data comprising some level of scrutiny rather than simply assuming the data is appropriate and correct.

Environmental, Social and Governance (ESG)

IVS 104 also includes an Appendix on ESG. This is a hot topic at the moment, and the IVSC recognises that the impact of ESG considerations on valuations is still in development, however highlights that the Valuer should be aware of relevant legislation and frameworks in relation to ESG factors which can impact a valuation.

IVS 104 also provide examples of environmental, social and governance that may impact valuations that may positively or negatively influence the valuation. These include:

- Environmental – air and water pollution, biodiversity, climate change (including future risks), clean water and sanitation, carbon and other gas emissions, deforestation, natural disasters, resource scarcity of efficiency, and waste management.

- Social – community relations, conflict, customer satisfaction, data protection and privacy, development of human capital (health and education), employee engagement, gender equality and racial equality, good health and well-being, human rights, working conditions and working environment.

- Governance – audit committee structure, board diversity structure, bribery and corruption, corporate governance, donations, ESG reporting standards and regulatory costs, executive remuneration, institutional strength, management succession planning, partnerships, political lobbying, rule of law, transparency, whistle-blower schemes

IVS requires measurable ESG factors to be considered in valuations if they are deemed reasonable by a Valuer applying professional judgement.

IVS 105 – Valuation Models

Similar to IVS 104, this is an existing topic in IVS which now has its dedicated section and covers the use of valuation models and what the Valuer should do when choosing a valuation model. In essence, IVS defines a valuation model as the implementation of a method which converts inputs into outputs used in the development of a value. Valuers will use models daily and they come in many forms, ranging from a company’s built-in valuation/data capture software, or a simple Excel sheet, to the most complex development feasibility and discounted cashflow models.

A common question Valuers get asked by homeowners when inspecting a house (whilst tapping away on their tablet) is “Does it tell you what the property is worth”? (referring to the tablet). The answer is no, but during the inspection, the Valuer is carefully selecting inputs which the model then converts into outputs which contribute to the assessment of the value. This could be concerning the quality and condition of the home, the level of landscaping, floor areas and various other factors. Another example could be in a commercial valuation model, where the inputs might be the rental return and market rent (not always the same thing), property expenses (outgoings) and capitalisation rate (yield).

A good model will convert these inputs into outputs by making the appropriate calculations, but the IVSC recognises that no model is perfect, so it is not always safe to assume the outputs are correct. If the valuation model isn’t fit for purpose, then the inputs may not correctly produce the right outputs, and so a degree of professional judgement is to be exercised by the Valuer. IVS 105 aims to provide clarity around this. And defines the characteristics of an appropriate valuation model (similar to IVS 104) as accuracy, completeness, timeliness and transparency.

IVS 106 – Documents and Reporting

The IVSC have increased the standards around documentation, which include the valuation report or advice itself, as well as background information, communication with the client, and working papers.

The documentation should detail the decisions made by the Valuer in arriving at the valuation conclusion, in a way that is clear and able to be explained to another profession. The intention is to promote consistency, professionalism, transparency, comparability, and trust in the valuation profession.

Asset Standards

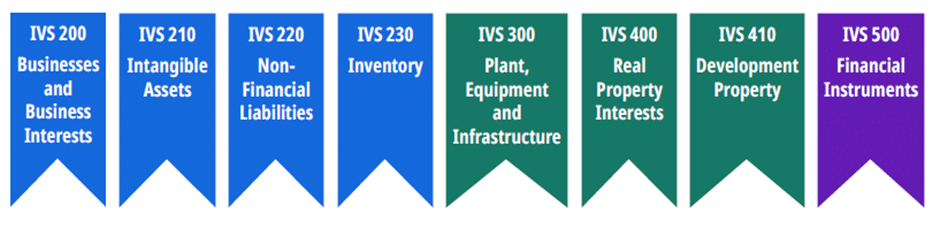

The 8 Asset Standards, which are standards applying to specific asset classes, are pre-existing standards, however, some refinements were made in the latest IVS. These include a clearer categorisation of the standards for non-property assets such as businesses and intangible assets, tangible assets, and financial instruments. These are newly categorised as follows:

These asset standards are too broad to cover, but in short, the latest version of the IVS includes some refinements and clarifications including:

- Adjustments to be made in the income approach for business valuations (IVS 200)

- Separate sections in line with General Standards are now included under Asset Standards for tangible assets, eg Scope of Works, Data and Inputs, Valuation Models, ESG and Documentation (IVS 300-410)

- Standards revisions for financial instruments (IVS 500)

Acumentis has been at the forefront of these updated standards since their announcement by the IVSC in January 2024. You can be sure when choosing Acumentis to give you certainty in your next property or business decision, that we align with Australian and International valuation protocols and standards. We have a dedicated national Risk & Performance Team, as well as a Quality Assurance framework, to ensure compliance with this ever-changing space.

If you would like to know more about these new standards, please reach out to a member of our team.

Error: Unable to load Block variation: showperson