Market Recovery and Demand Trends

After a period of softening during the first half of 2023, driven by increasing interest rates and inflationary pressures, market demand for licensed hotels in Queensland has rebounded over the past 12 months. Hotel operators have primarily adapted to the new ‘norm’ while battling increasing operational and wage costs.

Corporate Style Hotels in High Demand

Larger-scale, ‘corporate’ style hotels offering diverse trading profiles, including food and beverage, retail liquor sales, and strong-performing gaming fleets, are keenly sought after. This has resulted in a tightening of yields, with some recent freehold going concern sales reflecting yields as low as 8%, with around 10% being typical. Buyers include both local and southern-based hoteliers looking to expand their footprint.

Hotels with extensive land holdings and the potential for value addition through renovation or extension and restructuring of management have attracted the most attention. Hotels with traditionally strong underlying trading that have been poorly managed are also commanding stronger levels of demand, where purchasers can see the upside through more efficient management.

Regional Hotel Market Dynamics

Smaller-scale hotels in regional locations are also currently enjoying increased liquidity. However, increased sales activity and stronger demand levels have not generally translated into any significant movement in historical yield levels, which typically remain in the 15% to 20% range in coastal locations and above 20% for hotels ‘west of the divide’ in regional Queensland.

Groups like Black Rhino, Waymark, and Star Liquor remain active buyers in regional Queensland. Noted hoteliers, the Falvey Group, have recently acquired several hotels stretching from Haigslea to Toowoomba, including the Sundowner Saloon, Gatton View Hotel, Gowrie Road Hotel, and The Stock Hotel Toowoomba.

Stable Trading Conditions

Most hotels are experiencing reasonably stable trading conditions despite the recent increase in the tax excise on alcohol and subsequent increase in retail prices, which was widely expected to impact hotel turnover levels adversely. Hotels with diverse revenue profiles, including bars, food, retail liquor sales and gaming, have been able to weather this, as well as inflationary impacts on costs, including wages, energy, liquor and food supplies, with margins generally being maintained. It is noted that food offerings need to be carefully managed so that a hotel offers an attractive value proposition for customers while maintaining sufficient profit margins for the hotel operator.

The Role of Gaming in Hotel Valuations

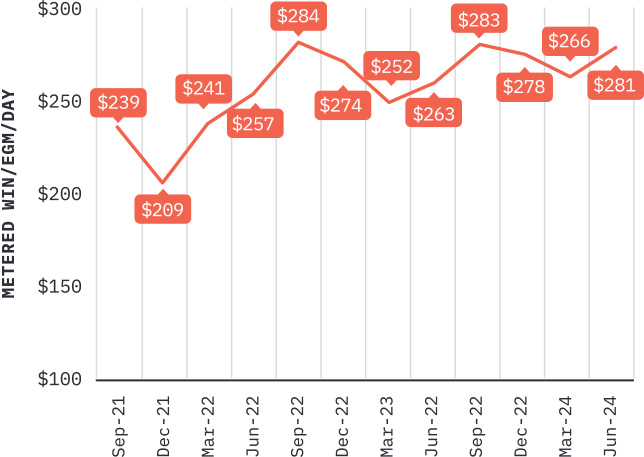

Gaming continues to be a strong driver of the value of licensed hotels in Queensland. Gaming turnover levels spiked significantly after the COVID-19 pandemic, and while they were expected to soften following the abatement of government support payments, they have remained relatively stable. The graph below demonstrates that metered daily win (turnover per machine per day) levels have remained reasonably stable over the past two years, with variances reflecting typical seasonal influences.

Increased Demand for Gaming Machine Operating Authorities

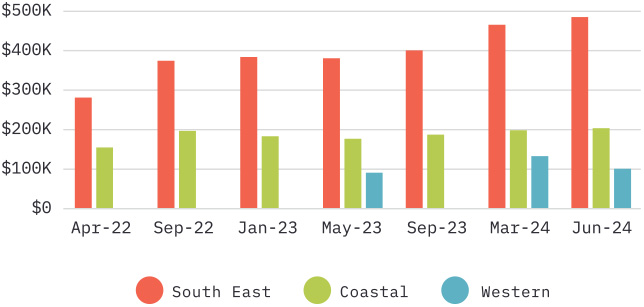

The improved performance of gaming machines has heightened demand for gaming machine operating authorities, particularly in the significantly stronger performing South East Queensland region.

Sellers of gaming machine operating authorities have been motivated to sell due to the reduction in the required contribution to consolidated revenue (effectively commission on sale). This contribution was initially reduced as a trial to 15%, ending on 30 June 2023, but has now been extended until 30 June 2025. This has resulted in a significant increase in the number of authorities offered for sale.

Tender Results and Market Trends

The table below summarises tender results over the past two years. The most recent tender (June 2024) resulted in increases of 4.1% for Southeast region authorities and 2.5% for Coastal authorities; however, the thinly traded Western authorities reflected a reduction of 24.2%. Notably, at the time of writing, not all of the Coastal region authorities offered for sale were taken up.

Venue Swapping

While the improved performance of gaming machines has driven the increase in tender prices, there is also anecdotal evidence of ‘venue swapping’, where multi-venue operators offer authorities for tender from venues considered to be underperforming or over-supplied, aiming to essentially acquire the authorities ‘back’ for other venues within their portfolio.

In summary, the Queensland licensed hotel market remains relatively buoyant. Southern-based hoteliers who have been priced out of their local market or are taking advantage of the equity created in their existing holdings by solid market conditions demonstrate a consistent willingness to invest in Queensland hotels where higher returns are typically available. Local hotel groups are also expanding their footprint to create economies of scale to combat inflationary pressures on operating margins. The number of hotels listed for sale in Queensland is relatively high. However, many are being offered at price levels that could be considered ‘speculative’ and not reflective of the true value of the hotel. Where hotels are appropriately priced, good market demand typically exists.