The Australian Carbon Credit Unit (ACCU) Scheme, previously known as the Emissions Reduction Fund (ERF), has been in place since 2012. What impact has it had on market dynamics and property values?

The ACCU Scheme (Carbon Farming Initiative) introduced a number of ways in which the use of agricultural assets could be modified to sequester (store) carbon (in soils and vegetation) or reduce (avoid) emissions (e.g. animal effluent management or savanna fire management). In doing so, these projects provided landowners with a potential additional or alternate source of income, encouraging them to change their management practices to comply with the carbon farming methodologies.

Evolution of Carbon Farming Practices

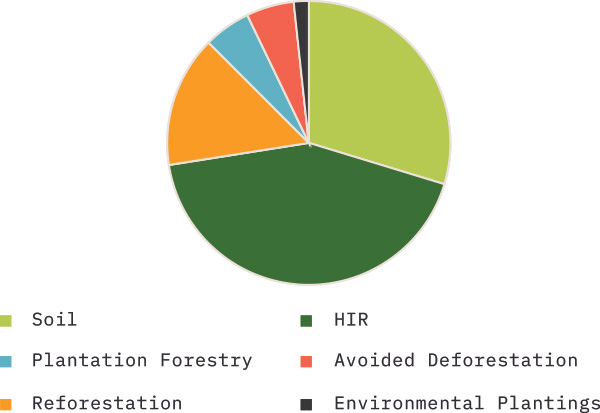

The largest method to date has been the Human-Induced Regeneration (HIR) Scheme, with many landowners, particularly those in the arid rangelands of Qld, NSW and WA, initially seeing it as a relatively quick and easier use of their land in comparison to traditional grazing practices which during 2015-2019 were subject to adversity due to ongoing drought and low commodity prices. This is shown in the chart below, noting that HIR makes up a substantial proportion of the ‘Vegetation’ category.

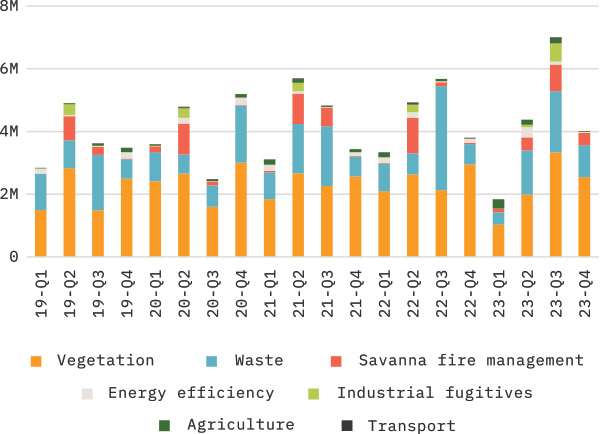

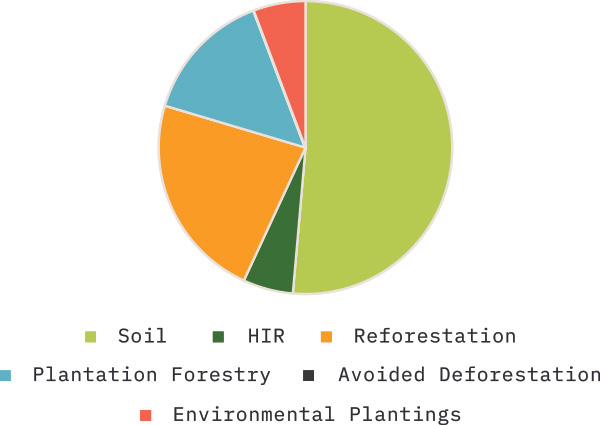

Since 2018, there has been a gradual uptake in other ACCU Scheme Projects, including environmental plantings and soil-based sequestration. The chart below highlights that, whilst ‘Vegetation’ still accounts for a large portion of ACCUs issued, there is greater variety in the types of projects being registered (including within the ‘Vegetation’ category itself).

Evaluating the Effectiveness of Carbon Farming Projects

Ultimately, it has been shown that many of the original estimates regarding the extent of potential carbon sequestration in HIR projects were overblown and that the compensation received was insufficient to offset the productivity loss (see example below).

ACCUs issued per method type

| Example Property | Pre-Project | Post-Project |

| Carrying Capacity | 615 AE | 575 AE |

| Land & Buildings Value | $4,500,000 | $4,230,000 |

| NPV of Income Stream | $0 | $119,000 |

| Total Value | $4,500,000 | $4,349,000 |

This appears to be part of the reasoning, along with more significant integrity concerns, behind the closure of the HIR method on 30 September 2023. However, other carbon farming options remain available for agricultural landowners interested in establishing an ACCU Scheme project on their property.

Market Dynamics and Buyer Interest

Given the extent to which the HIR method, in particular, has been adopted throughout the pastoral regions of Australia, it is perhaps not surprising that market dynamics have been significantly influenced in those areas, where portions of farms/stations that were historically considered to provide limited benefit, could now be utilised to provide an income.

As a result, increased demand for suitable properties has been evident from various buyer groups, including:

- Values-Based Decision Makers: Conservation groups seeking to invest in environmental sustainability.

- Carbon Offset Businesses: Companies, particularly large emitters like energy and mining sectors, looking to offset their carbon footprint.

- Farming Businesses: Operators aiming to secure their own ‘net-zero’ status and/or additional income streams.

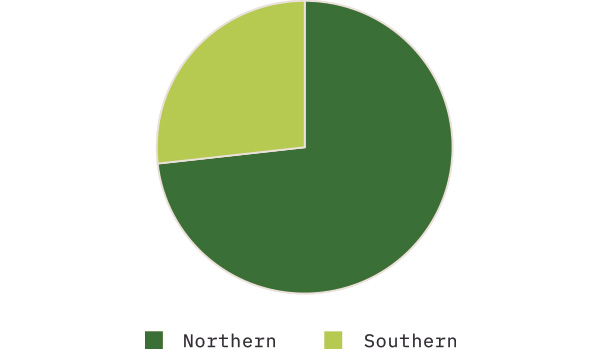

It has been particularly noticeable that ‘big emitters’ (power generators, mining, etc.) are willing to pay significant premiums in northern and western regions for properties that are suitable for carbon sequestration, assisting those (large emitter) businesses to achieve ‘net zero’ status. Often, this will involve a transition in land use for much of the property to maximise the carbon abatement. However, where areas of the property remain suitable for agricultural uses (e.g. cropping and grazing), the companies may lease those portions to farming operators.

On the other hand, southern markets such as southern NSW, south-east South Australia, Victoria, and Tasmania are yet to see a noticeable shift in market dynamics due to the ACCU Scheme. Vegetation projects are not as suited to the higher rainfall areas, and soil sequestration projects (which are more suited) are still in their relative infancy. As a result, the dominant market participants continue to be local landowners looking to expand their footprint. In fact, with the recent softening of market conditions, it is apparent that ACCU-motivated purchasers are still not stepping in to take advantage of limited competition from the traditional buyer set.

With the significant uplift in agricultural land values over the last ten years, it is difficult to determine precisely what influence the ACCU Scheme has had on property values since its introduction. Other factors, such as a run of favourable seasonal conditions, strong commodity prices and historically low interest rates, have also had strong influences. However, what is clear is that the ACCU Scheme is impacting how market participants consider the appeal and utility of agricultural properties, particularly in areas where ACCU Scheme methods are well established and understood.