Last year, we highlighted the critical lessons about ensuring adequate insurance coverage amidst increasing severe weather conditions and volatile construction costs. The case study of a high-end complex of 50 apartments that suffered significant damage from a tropical cyclone served as a stark reminder of the financial implications of underinsurance.

Constructions Costs: Trends & Impacts

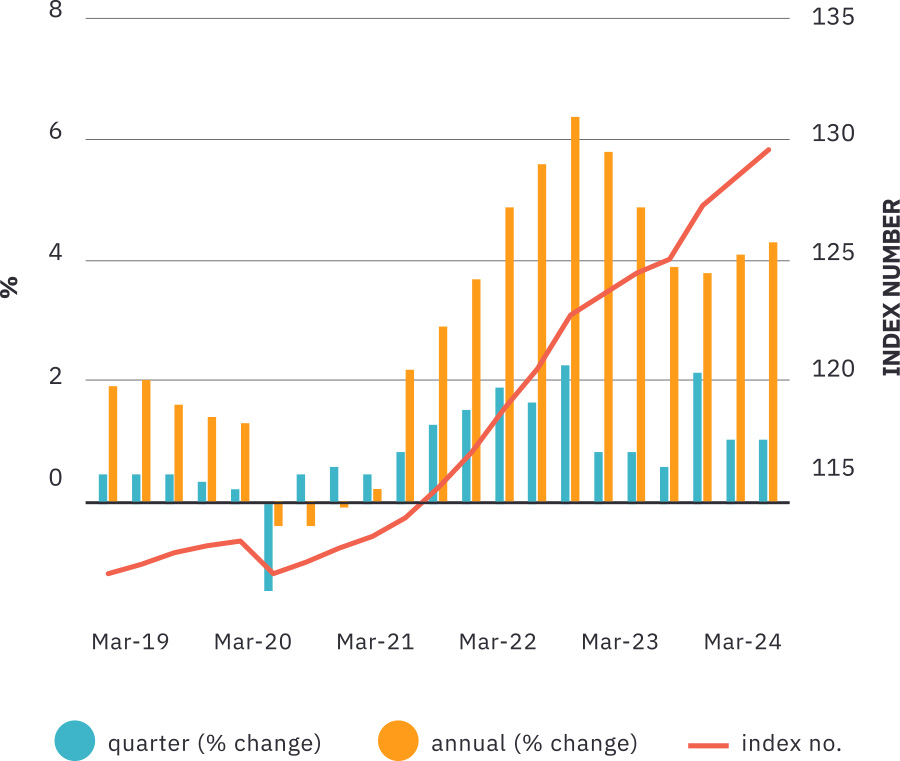

Fast-forward to today, and the construction landscape continues to evolve. Building construction prices have risen 1.6% this quarter and 5.9% over the past twelve months. This increase is driven by ongoing labour shortages for skilled tradespeople, with industry demand placing upward pressure on output costs. While most material prices have stabilised, prices for concrete-based structural components have increased due to high demand, high manufacturing costs, and labour shortages.

The Catch-22: Housing Shortage vs. Rising Costs

These escalating and volatile construction costs present a Catch-22 situation. On one hand, there is a pressing need to build and address Australia’s housing shortage. On the other hand, rising costs act as a disincentive, holding back Australia’s housing construction recovery.

The Need for Insurance Assessment Updates

As we navigate these complex issues, the lessons from the past remain relevant. It is dangerous to adopt escalations each year, as these may not have kept up with actual building cost increases. The pressure and demand for reconstruction, especially in weather-affected areas, are expected to strain construction costs further and flow into the broader construction industry.

Given these challenges, the importance of regularly assessing your property insurance cannot be overstated. As construction costs continue to rise, so does the potential for underinsurance. Regular assessments ensure that your coverage keeps pace with these changes, providing peace of mind in the face of uncertainty.

The construction industry’s current state presents both challenges and opportunities. Regular insurance assessments are crucial to this journey, safeguarding investments and contributing to the industry’s overall resilience.