Location, location, location!

The success of a car wash business is heavily dependent upon its location which is the primary consideration. Other important factors include management, competition, proximity to retail businesses, population growth and ease of access to passing traffic. The individual buildings need to be constructed with an adequate turning radius, setbacks, easy access and clear line of sight from major arterial roads.

Successful facilities include a mixture of full service, automatic and self-serve car wash bays with vacuum bays, as well as vending machines for car cleaning and fragrance products and dog wash units. Car wash facilities can be operated unmanned and often have a 24 hour a day 7 day week operation with staffed hours generally only during the day to correlate with busier periods of trade.

At Acumentis we have observed that the performance of the individual car wash business benefits from active on-site management including regular repairs, maintenance and cleaning. Sites which present to a high standard and are well maintained appear to attract higher levels of patronage compared to poorly maintained and presented sites. We have also noticed a correlation between additional complimentary services such as hand washing pre-automatic washes and increased levels of trade, although acknowledging the increased staffing associated with these services.

Car Wash Valuations | Specialist Valuer Henry Brown

Weather Impacts

The car wash industry is heavily dependent upon prevailing weather conditions. During periods of drought with increased statutory limitation on water usage, the car wash industry enjoys favourable conditions. Alternatively, during periods of inclement weather the industry suffers significant falls in business.

We have increasingly seen operators diversifying their offering and income streams with additional ‘value add’ services such as laundromats which often perform stronger during periods of wet weather which can help offset diminished car wash sales during these periods.

Recycling Water

There is increasing emphasis on recycled water, which requires the use of filtration systems and storage tanks to assist in the processing of recycled water.

Given the increased public awareness of the necessity to efficiently use water, the restrictions upon water usage for car cleaning at home along with the increase in population and car usage, there will be a continually growing market for the car wash industry. Entry to this market is limited by the availability of sites, therefore established car wash facilities have good prospects for stable market conditions however they are highly management sensitive requiring reliable equipment and competitive pricing.

Car Wash Industry Outlook

The Car Wash industry has evolved over the past 20 years and is intrinsically linked to the motor vehicle sales industry. The sales of new motor vehicles have grown rapidly in Australia over the past 10 – 15 years. As the number of cars increase on Australian roads, and in particular new cars, the requirement for car wash and detailing services also increases. Many new car owners tend to wash their cars with more frequency than older vehicles reflecting the desire to adequately maintain and preserve resale values.

Rental Affordability

From our analysis, car wash rents are directly related to the income and profitability of the car wash. That proportion of income and profit which represents a fair rent is set by the market and needs to be at a level that provides a fair return to both the Lessee and Lessor. This will fluctuate depending on the car wash’s income and profit levels and style of operation. Rents that are in excess of 50% of the Lessee’s net operating profit (before rent) are generally considered to be unsustainable. The industry benchmark ratios for car wash rentals are generally considered to be within the 35% to 45% of net operating profit (before rent) range. Variances reflect the location and age, condition and presentation of improvements and plant and equipment, configuration of wash bay types offered, as well as the availability of ancillary income from the operation of vacuums, vending machines and dog washes.

Barriers to Entry

There is increased difficulty associated with obtaining well exposed sites which offer appropriate characteristics in terms of size, access and appropriate surrounding demographics. This coupled with the difficulty obtaining development approvals as well as increased construction and equipment costs, underpin the value of existing car wash sites in the market.

Yield Compressions

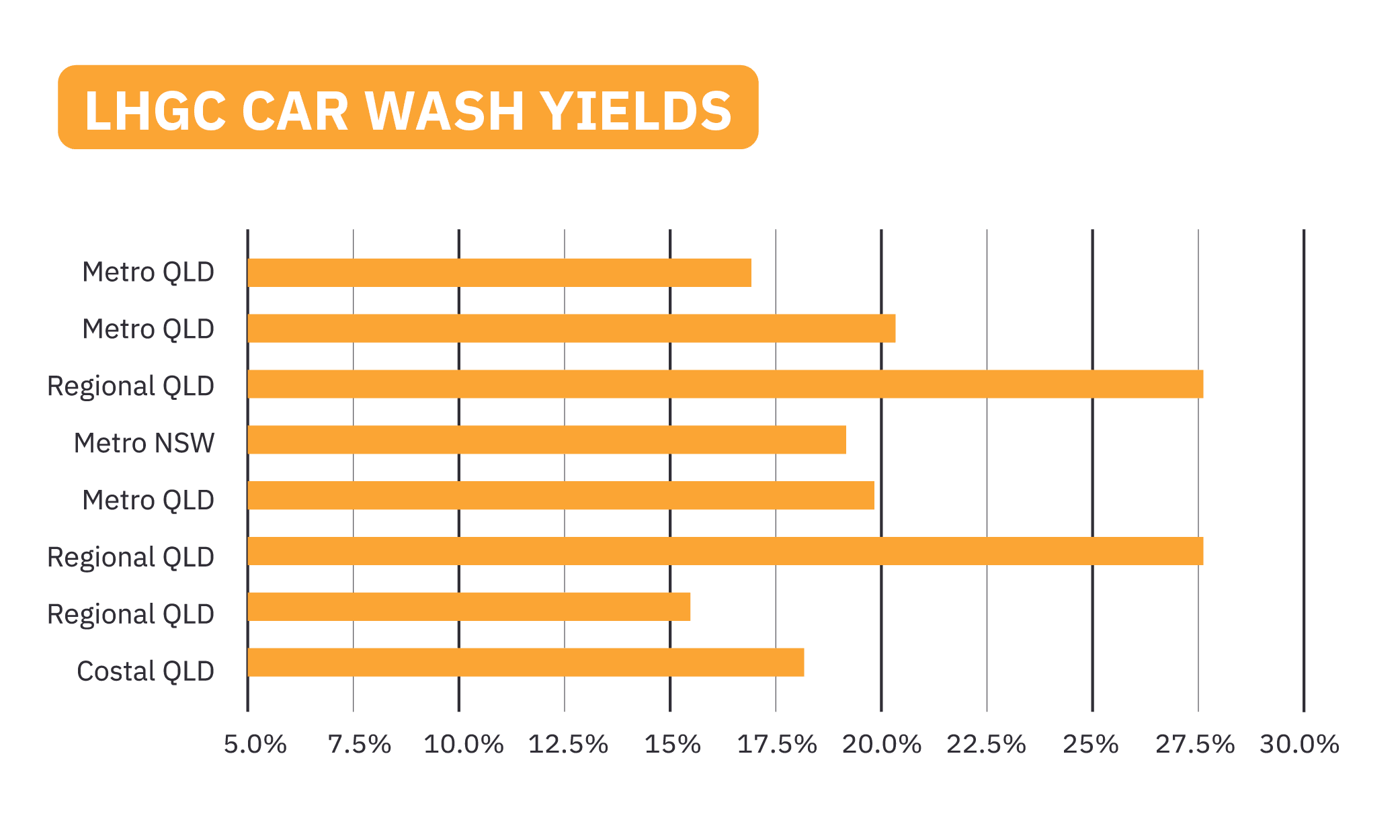

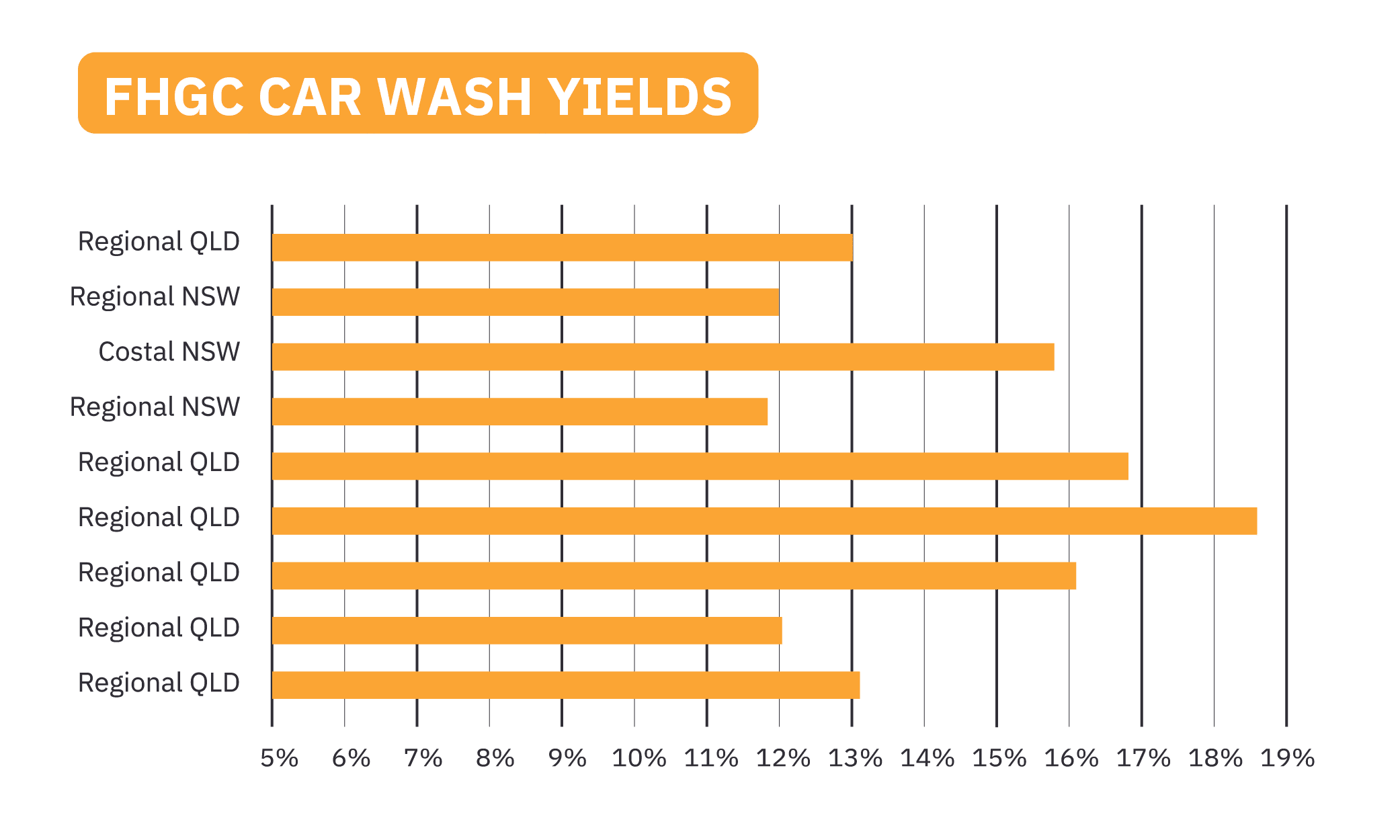

In recent years we have witnessed yield compression of Freehold Going Concern Car Wash (FHGC) sites throughout Queensland and New South Wales, with yields for well-maintained modern car washes in established locations ranging from between 12% - 18%. Whilst Lessee Interest or Leasehold Going Concern Car Wash (LHGC) sales range from between 15% - 27% and are heavily correlated with remaining lease term, recognising the inverse relationship between lease tenure and yields.

Another factor influencing the sales of going concern car wash businesses is the availability of historical financial reports. Sites with well documented financials including profit and loss records, sales reports and detailed expenses are more likely to transact strongly as they provide the purchaser with more certainty and allow for more streamlined financing applications.

Yields of recent Going Concern Car Wash transactions can be evidenced on the tables below: