The details

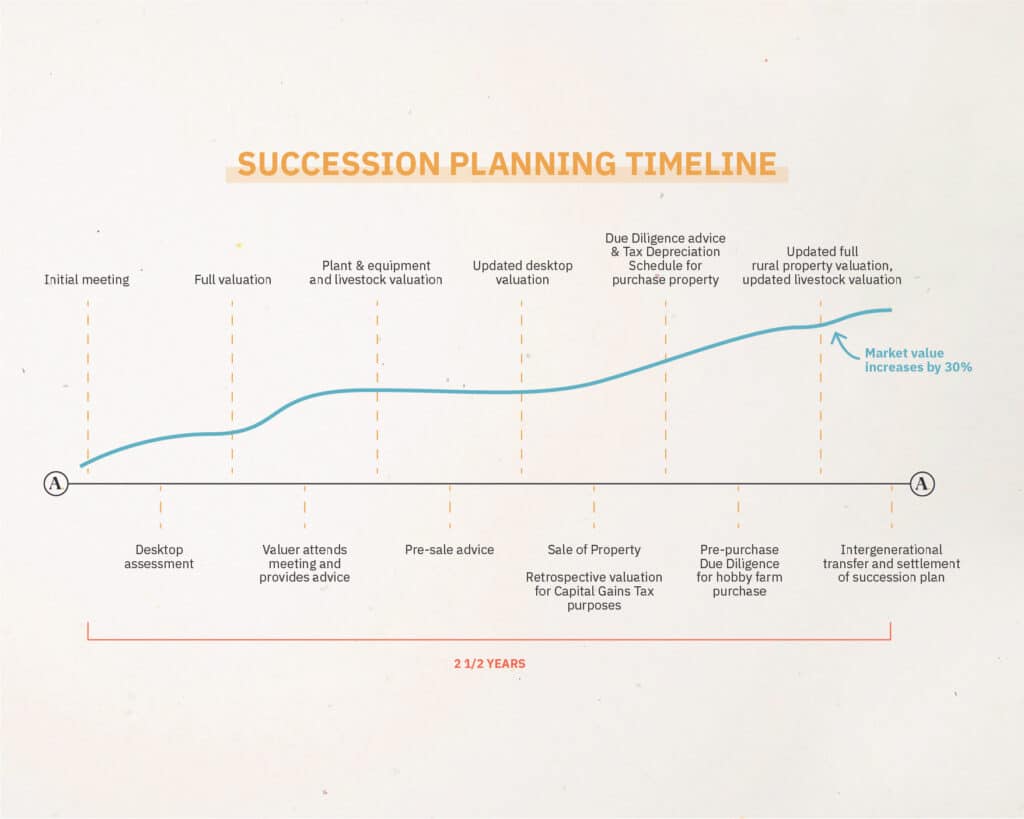

- 2.5 year succession planning process from first succession planning meeting to conclusion, resulting in the family farm and occupying agribusiness being transferred to one of the children.

- The enterprise includes two rural properties, items of plant & equipment, and livestock. Each of the rural properties can support one family unit.

- Family is defined as parents (current owners), and two children – one of which works on the farms and the other who works off farm.

- Market value increased 30% over the 2.5 year period.

Where we add expertise

Here’s how we supported this family through the succession planning of their family farm.

Initial meeting

Discussions with family, lawyer and accountant. Acumentis expert attends a part of the initial meeting to understand the assets involved and meet the family and all service providers.

Desktop assessment

All professional service providers report back at a second meeting on high level review with initial advice. Acumentis provides a desktop assessment of property assets providing the market value of assets for succession planning discussions.

Full valuation

Acumentis undertakes a full valuation of the properties for financier – Mortgage Security Valuation. This full report is issued to the family for the purpose of succession planning. Acumentis re-assign the full Mortgage Security Valuations to a new lender (within 90 days of the valuation date) after the family chose to re-finance to an alternate deal.

Advice and insights

Acumentis Valuer attends succession planning meeting and discusses the market, their basis of valuation and the factors that are driving the market at present. Other property options are discussed for the family including hobby farms (potential for parents) and entry level rural properties near the off-farm siblings place of employment.

Plant & equipment and livestock valuation

Acumentis assess the value of the plant, machinery and equipment and livestock forming part of the total agribusiness enterprise.

Pre-sale advice

The family wishes to sell one of the two rural properties to pay down debt and free up some cash/capital to assist in the succession planning process.

The Acumentis valuer is involved in discussions around the selling strategy, the selection of an appropriate sales agent, which method of sale would be most appropriate for their property. Pre- sales advice is supplied around how the family might be able to extract further value from their property/ies through strategic capex or development.

Update desktop valuation

An updated desktop valuation is undertaken on the property for sale to set appropriate reserve for the pending auction.

Sale of property & retrospective valuation

Property sells at auction. Acumentis provides retrospective valuation advice for accountant and solicitor to address any capital gains tax requirements.

Pre-purchase advice & tax depreciation schedule: Acumentis valuer is involved in discussion with the family providing market knowledge and insights for entry level rural properties near the off-farm siblings place of employment.

Acumentis represents the family in pre-purchase due diligence and negotiation, resulting in the purchase of a suitable property.

Pre-purchase advice and due diligence

Parents purchase a leased investment property in their superfund and a hobby farm for their retirement. Throughout this process Acumentis represented the parents in pre-purchase due diligence and negotiation to secure the suitable property.

Updated full valuations

An updated full valuation was prepared on the remaining rural property, along with an updated livestock valuation. Valuation prepared for the financier and the family for succession planning purposes. Due to increased values across land and livestock and subsequent increased equity, the family can bring forward plans to transfer the property and agribusiness to the on-farm sibling.

Intergenerational transfer

Final succession planning meeting with all of family, lawyer, accountant and valuer. Succession plan is finalised and executed with the intergenerational transfer of remaining agribusiness assets to on-farm sibling.